Devy Ratnasari

Government bonds buyer predictions

The analysis is conducted to predict how much government bonds the company has to order based on the users behaviour. The dataset is sourced from Indonesia Fintech StartUp between August and October 2021.

Users information

This dataset contains:- user_id - User's identity

- registration_import_datetime - Date of user registered

- user_gender - Gender of the user

- user_age - Age of the user

- user_occupation - Occupation of the user

- user_income_range - Range income of the user

- referral_code_used - If the user using referral code during registration or not

- user_income_source - The source of income from the user

| user_id | registration_import_datetime | user_gender | user_age | user_occupation | user_income_range | referral_code_used | user_income_source | |

|---|---|---|---|---|---|---|---|---|

| 0 | 162882 | 2021-09-17 | Female | 51 | Swasta | > Rp 500 Juta - 1 Miliar | NaN | Gaji |

| 1 | 3485491 | 2021-10-09 | Female | 55 | Others | > Rp 50 Juta - 100 Juta | NaN | Gaji |

| 2 | 1071649 | 2021-10-08 | Male | 50 | Swasta | Rp 10 Juta - 50 Juta | NaN | Gaji |

| 3 | 3816789 | 2021-08-12 | Female | 53 | IRT | > Rp 50 Juta - 100 Juta | NaN | Gaji |

| 4 | 3802293 | 2021-08-15 | Female | 47 | PNS | > Rp 500 Juta - 1 Miliar | used referral | Gaji |

User's daily transaction

This dataset contains:- user_id - Id of user, it's same with the user_id from dataset 1

- date - Transaction date

- Saham_AUM - AUM (../assets Under Management) of equity mutual fund held by client to date

- Saham_invested_amount - The total price paid by client to buy equity mutual fund to date.

- Saham_transaction_amount - Total value of transaction to buy (if positive) or sell (if negative) equity mutual fund on the date.

- Pasar_Uang_AUM - AUM of money market mutual fund held by client to date

- Pasar_Uang_invested_amount - The total price paid by client to buy money market mutual fund to date

- Pasar_Uang_transaction_amount - Total value of transaction to buy (if positive) or sell (if negative) money market mutual fund on the date.

- Pendapatan_Tetap_AUM - AUM of fixed income mutual fund held by client to date

- Pendapatan_Tetap_invested_amount - The total price paid by client to buy fixed income mutual fund to date

- Pendapatan_Tetap_transaction_amount - Total value of transaction to buy (if positive) or sell (if negative) fixed income mutual fund on the date.

- Campuran_AUM - AUM of mixed mutual fund held by client to date

- Campuran_invested_amount - The total price paid by client to buy mixed mutual fund to date

- Campuran_transaction_amount - Total value of the transaction to buy (if positive) or sell (if negative) mixed mutual fund on the date.

| user_id | trans_date | Saham_AUM | Saham_invested_amount | Saham_transaction_amount | Pasar_Uang_AUM | Pasar_Uang_invested_amount | Pasar_Uang_transaction_amount | Pendapatan_Tetap_AUM | Pendapatan_Tetap_invested_amount | Pendapatan_Tetap_transaction_amount | Campuran_AUM | Campuran_invested_amount | Campuran_transaction_amount | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 50701 | 2021-08-30 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 10132277.0 | 10000000.0 | 0.0 |

| 1 | 50701 | 2021-08-31 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 10206945.0 | 10000000.0 | 0.0 |

| 2 | 50701 | 2021-09-01 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 9956556.0 | 10000000.0 | 0.0 |

| 3 | 50701 | 2021-09-02 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 9914858.0 | 10000000.0 | 0.0 |

| 4 | 50701 | 2021-09-03 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 10016360.0 | 10000000.0 | 0.0 |

Bonds history purchase

This dataset contains:- user_id - ID of the user, same as dataset 1 and 2

- flag_order_bond - 1 if the user ordered bonds, 0 for the opposite

- bond_units_ordered - The total of bond that user ordered

| user_id | flag_order_bond | bond_units_ordered | |

|---|---|---|---|

| 0 | 50701 | 1 | 34 |

| 1 | 50961 | 1 | 99 |

| 2 | 51883 | 0 | 0 |

| 3 | 53759 | 0 | 0 |

| 4 | 54759 | 1 | 92 |

Users

We want to see how much the total of data that we have and the datatype, if there

are any duplicate in our data, null value or any other problem that we need to taking care of.

print(f'Total Row: {user.shape[0]} , Column: {user.shape[1]}')

user.info()Total Row: 14712 , Column: 8 RangeIndex: 14712 entries, 0 to 14711 Data columns (total 8 columns): # Column Non-Null Count Dtype --- ------ -------------- ----- 0 user_id 14712 non-null int64 1 registration_import_datetime 14712 non-null period[D] 2 user_gender 14712 non-null object 3 user_age 14712 non-null int64 4 user_occupation 14712 non-null object 5 user_income_range 14712 non-null object 6 referral_code_used 5604 non-null object 7 user_income_source 14712 non-null object dtypes: int64(2), object(5), period[D](1)

There are 14712 rows of data with 8 columns for the dataset 1, we can see that on

the column referral_code_used there are only 5604 rows of non-null data

the next step that we will do is to double check null value in the dataset and if any duplicate

user_id since the user_id is our primary key.

is_duplicate_user = user.user_id.duplicated().sum()

total_user = user.user_id.count()

print(f'Total Duplicate User_ID : {is_duplicate_user}')

print(f'Total User : {total_user}')

user.isnull().sum()Total Duplicate User_ID : 0 Total User : 14712 user_id 0 registration_import_datetime 0 user_gender 0 user_age 0 user_occupation 0 user_income_range 0 referral_code_used 9108 user_income_source 0 dtype: int64

From the result above, it's confirmed that we have 9108 rows of null value in

column referral_code_used

and luckily, we don't have any duplicate data for the user_id so we can continue to decide what

to do with the null value.

We will be checking for the unique value from each column in the dataset to help us deciding

what to replace the null value with.

for x in user:

uniqueValues = user[x].unique()

n_values = len(uniqueValues)

if n_values <=50:

print(f'Column: {x} -- total unique value: ({n_values}) {uniqueValues}')Column: user_gender -- total unique value: (2) ['Female' 'Male'] Column: user_occupation -- total unique value: (9) ['Swasta' 'Others' 'IRT' 'PNS' 'Pengusaha' 'Pensiunan' 'TNI/Polisi' 'Guru''Pelajar'] Column: user_income_range -- total unique value: (6) ['> Rp 500 Juta - 1 Miliar' '> Rp 50 Juta - 100 Juta' 'Rp 10 Juta - 50 Juta' '< 10 Juta' '> Rp 100 Juta - 500 Juta' '> Rp 1 Miliar'] Column: referral_code_used -- total unique value: (2) [nan 'used referral'] Column: user_income_source -- total unique value: (10) ['Gaji' 'Keuntungan Bisnis' 'Lainnya' 'Dari Orang Tua / Anak' 'Undian' 'Tabungan' 'Warisan' 'Hasil Investasi' 'Dari Suami / istri' 'Bunga Simpanan']By checking the unique value, we can see the categorical data of each column. We notice that there are only 2 categories from referral_code_used, which is nan or 'used referral'. We will be converting the null value to none instead of nan or deleting the data.

user.referral_code_used.fillna('None', inplace = True)

user.referral_code_used.unique()

user.isnull().sum()array(['None', 'used referral'], dtype=object) user_id 0 registration_import_datetime 0 user_gender 0 user_age 0 user_occupation 0 user_income_range 0 referral_code_used 0 user_income_source 0 dtype: int64We successfully convert the null value to none. Then we will start our analysis by checking the user registration growth between August and October 2021. We will visualise the chart by daily and monthly registration.

user['registration_import_datetime'].value_counts().sort_index().plot()

plt.title('User Join Growth by Day')

user['registration_month'] = user.registration_import_datetime.dt.to_timestamp('m').copy()

user.registration_month.value_counts().sort_index().plot()

plt.title('User Join Growth by Month')

plt.show()

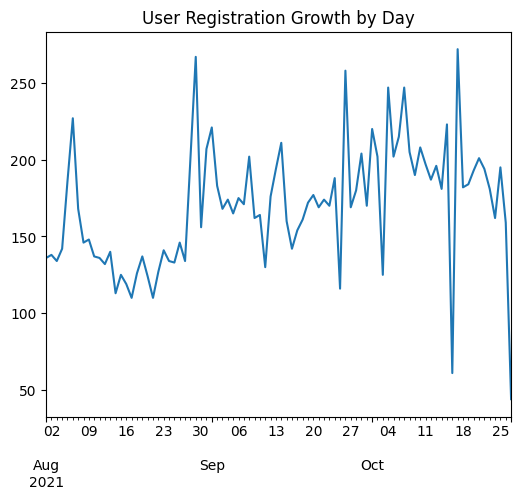

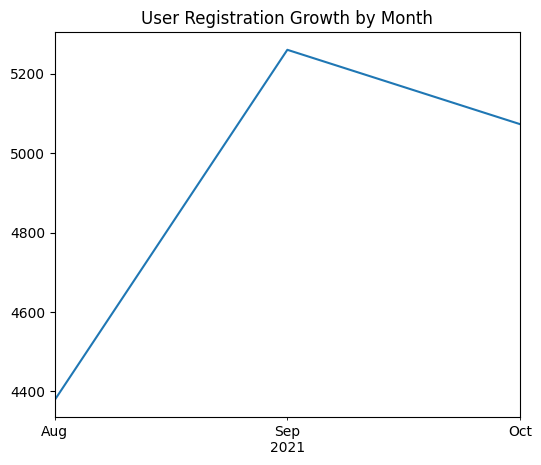

In the daily registration chart, we can see that October is the month with the

lowest and highest number of registrations,

meanwhile when we try to visualise it on monthly basis we can see that September is the month

with the highest number of registration, around 5200 users signed up.

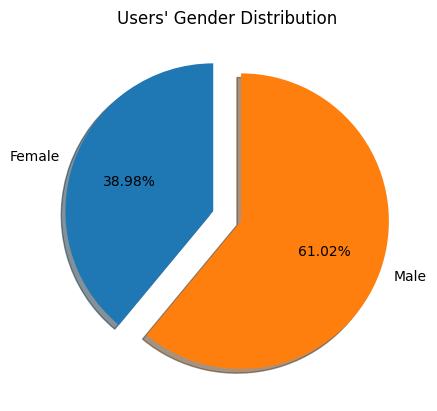

Next, we want to see the comparison by user's gender.

gender = user[['user_id', 'user_gender']].groupby('user_gender').count()

plt.pie(gender.user_id, labels=gender.index , startangle=90, shadow=True,explode=(0.1, 0.1), autopct='%1.2f%%')

plt.title('Users\' Gender Distribution')

plt.show()

The user's gender distribution chart show that around 61.02% of our users are

male, meanwhile the rest are female.

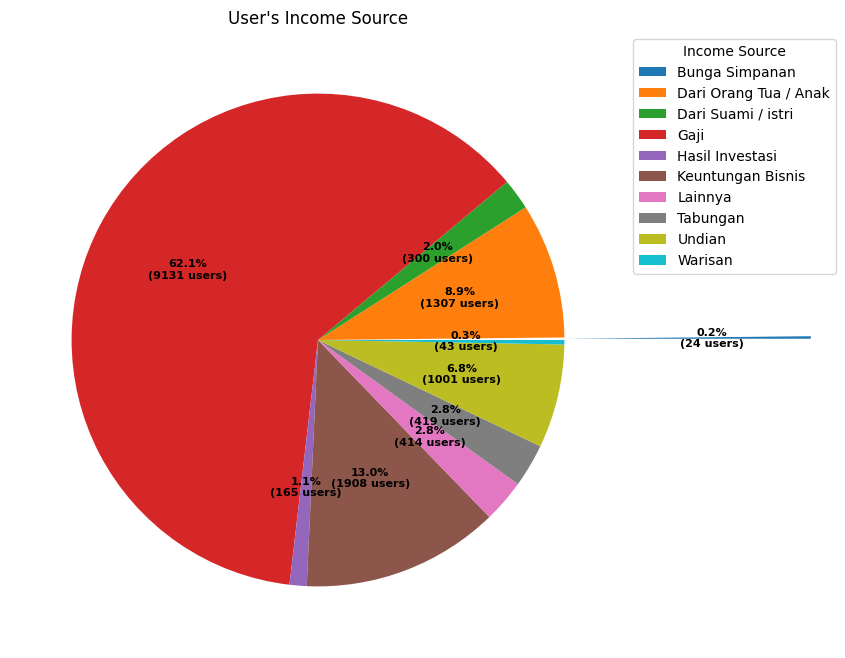

Then we will try to visualise the user's range and source of income to see more details of it.

fig, ax = plt.subplots(figsize=(8, 8), subplot_kw=dict(aspect="equal"))

income_source = user[['user_id', 'user_income_source']].groupby('user_income_source').count

def func(pct, allvals):

absolute = int(np.round(pct/100.*np.sum(allvals)))

return "{:.1f}%\n({:d} users)".format(pct, absolute)

wedges, texts, autotexts = ax.pie(income_source.user_id, autopct=lambda pct: func(pct, income_source.user_id),

textprops=dict(color="black"), explode=(1,0,0,0,0,0,0,0,0,0))

ax.legend(wedges, income_source.index,

title="Income Source",

loc="upper left",

bbox_to_anchor=(1, 0, 0.5, 1))

plt.setp(autotexts, size=8, weight="bold")

ax.set_title("User's Income Source")

plt.show()

We read the chart counterclockwise starting from the exploded pie.

It shows that the lowest income source is from Bunga Simpanan (Saving's interest) with 0.2%.

whilst the majority of the income source is from Gaji (Salary) with 62.1% or equal to 9131

users.

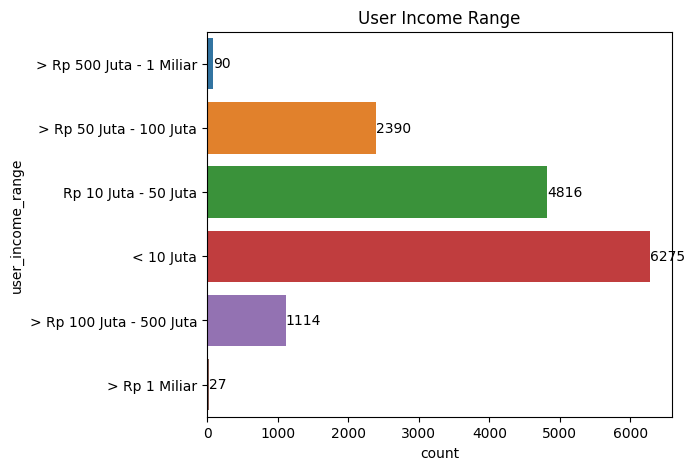

Then we will see for the user's income range.

fig, ax = plt.subplots(figsize=(6, 5))

ax = sns.countplot(y= user.user_income_range, data = user)

ax.set_title('User Income Range')

for x in ax.containers:

ax.bar_label(x, label_type='edge')

plt.show()

The user income range chart shows that the majority of users' income range is less than 10 Million Rupiah (approx 630 USD) with 6275 users.

Nevertheless, there are 27 users with the highest income range - 1 Billion Rupiah (approx 63000 USD) which is our potential big investor.

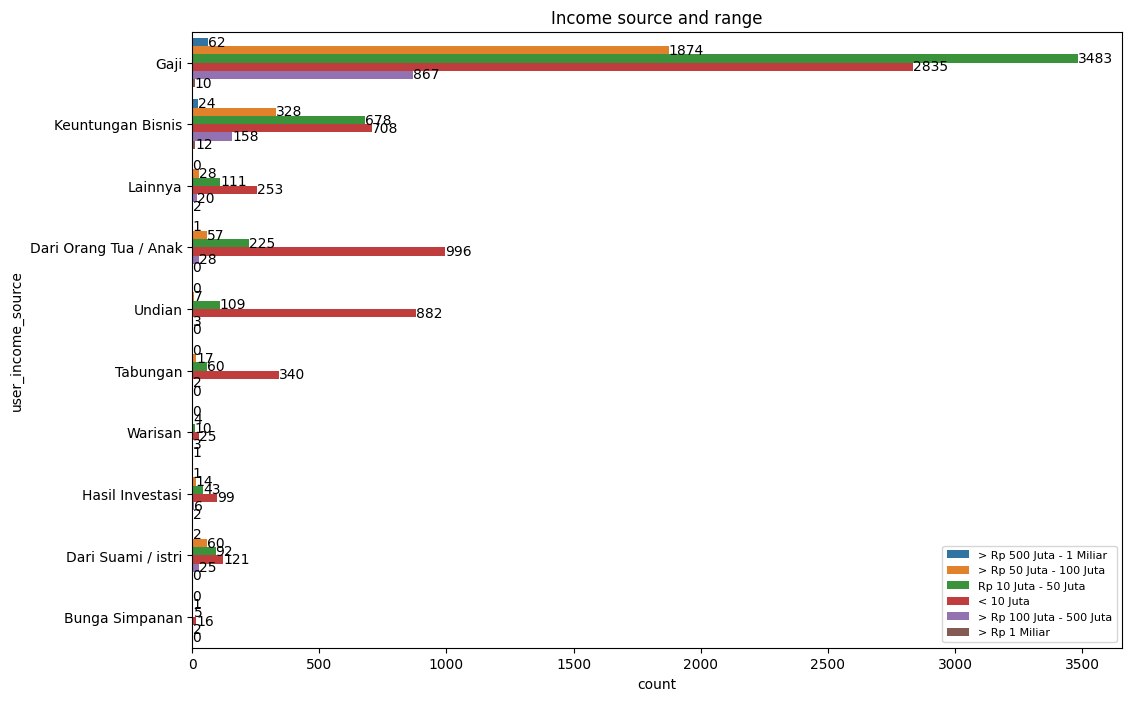

We also will try to combine income sources and range to see the breakdown of it.

fig, ax = plt.subplots(figsize=(12, 8))

ax = sns.countplot(y= user.user_income_source, hue=user.user_income_range, data = user)

ax.set_title('Income source and range')

for x in ax.containers:

ax.bar_label(x, label_type='edge')

ax.legend(loc='best', fontsize=8)

plt.show()

From the income range and source chart, we can see that 2835 of our users had wages of less than 10 Million Rupiah.

Moreover, the majority of our user's salary income range is between 10 Million to 50 Million Rupiah with a total of 3483 users.

It is noticeable that there are 10 users had a salary of more than 1 Billion Rupiah.

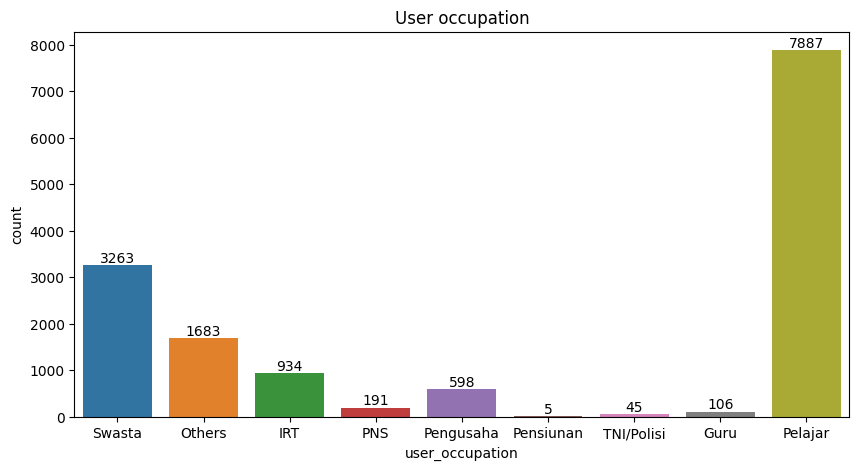

We will try to visualise the distribution of our user's occupations.

fig, ax = plt.subplots(figsize=(10, 5))

ax =sns.countplot(x=user.user_occupation)

for x in ax.containers:

ax.bar_label(x, label_type='edge')

ax.set_title('User occupation')

plt.show()

The users' occupation chart shows that the majority of our users are Pelajar

(Student) with a total of 7887 users.

Which is make sense that our majority income range is less than 10 Million.

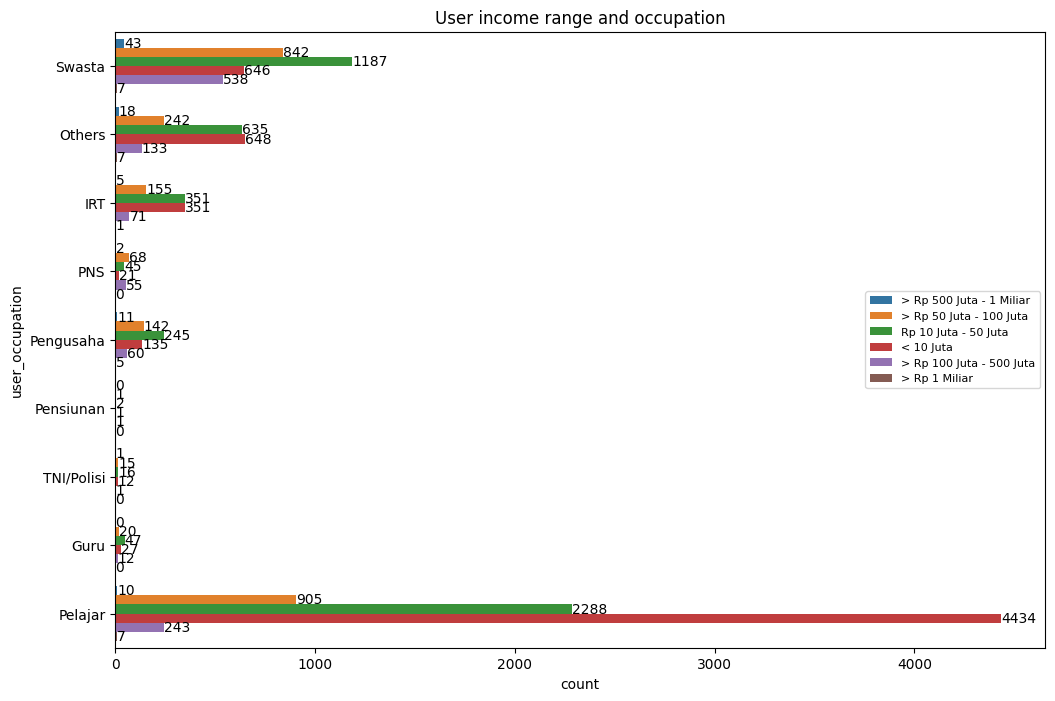

We will try to combine the income range and user occupation to see more details about it.

fig, ax = plt.subplots(figsize=(12, 8))

ax = sns.countplot(y= user.user_occupation, hue=user.user_income_range, data = user)

ax.set_title('Income range and occupation')

for x in ax.containers:

ax.bar_label(x, label_type='edge')

ax.legend(loc='right', fontsize=8)

plt.show()

When we combined the income range and occupation, we found interesting

information that we have 17 students with an income range of more than 500 Million Rupiah.

So we will investigate a little bit further about the 17 students.

pelajar_age = user.query('user_occupation == \'Pelajar\' and (user_income_range == \'> Rp 500 Juta - 1 Miliar\'

sor user_income_range == \'> Rp 1 Miliar\')')| user_id | registration_import_datetime | user_gender | user_age | user_occupation | user_income_range | referral_code_used | user_income_source | registration_month | |

|---|---|---|---|---|---|---|---|---|---|

| 619 | 4228712 | 2021-10-05 | Male | 17 | Pelajar | > Rp 1 Miliar | used referral | Keuntungan Bisnis | 2021-10-31 |

| 899 | 3795261 | 2021-08-08 | Male | 18 | Pelajar | > Rp 1 Miliar | used referral | Lainnya | 2021-08-31 |

| 1394 | 4376258 | 2021-10-19 | Male | 18 | Pelajar | > Rp 500 Juta - 1 Miliar | used referral | Gaji | 2021-10-31 |

| 2282 | 3818578 | 2021-08-16 | Male | 19 | Pelajar | > Rp 1 Miliar | None | Keuntungan Bisnis | 2021-08-31 |

| 2609 | 3742646 | 2021-08-09 | Female | 20 | Pelajar | > Rp 1 Miliar | None | Keuntungan Bisnis | 2021-08-31 |

| 3999 | 3749935 | 2021-08-04 | Female | 21 | Pelajar | > Rp 1 Miliar | None | Keuntungan Bisnis | 2021-08-31 |

| 4076 | 4245492 | 2021-10-07 | Female | 21 | Pelajar | > Rp 500 Juta - 1 Miliar | None | Keuntungan Bisnis | 2021-10-31 |

| 4569 | 4355874 | 2021-10-17 | Male | 21 | Pelajar | > Rp 1 Miliar | used referral | Keuntungan Bisnis | 2021-10-31 |

| 6135 | 4239037 | 2021-10-06 | Female | 23 | Pelajar | > Rp 500 Juta - 1 Miliar | used referral | Gaji | 2021-10-31 |

| 8322 | 4371352 | 2021-10-19 | Male | 25 | Pelajar | > Rp 500 Juta - 1 Miliar | used referral | Gaji | 2021-10-31 |

| 8871 | 3959126 | 2021-09-02 | Female | 26 | Pelajar | > Rp 500 Juta - 1 Miliar | used referral | Keuntungan Bisnis | 2021-09-30 |

| 9063 | 4342801 | 2021-10-17 | Male | 26 | Pelajar | > Rp 500 Juta - 1 Miliar | None | Gaji | 2021-10-31 |

| 9725 | 4270298 | 2021-10-09 | Female | 27 | Pelajar | > Rp 500 Juta - 1 Miliar | None | Keuntungan Bisnis | 2021-10-31 |

| 10101 | 4134537 | 2021-09-24 | Male | 28 | Pelajar | > Rp 500 Juta - 1 Miliar | None | Keuntungan Bisnis | 2021-09-30 |

| 10925 | 4338825 | 2021-10-15 | Male | 29 | Pelajar | > Rp 1 Miliar | used referral | Lainnya | 2021-10-31 |

| 11617 | 4164878 | 2021-10-02 | Male | 31 | Pelajar | > Rp 500 Juta - 1 Miliar | used referral | Keuntungan Bisnis | 2021-10-31 |

| 11950 | 3858112 | 2021-08-18 | Female | 32 | Pelajar | > Rp 500 Juta - 1 Miliar | None | Gaji | 2021-08-31 |

It's interesting that we have a few users aged below 20, as a student with

an income range above 500 Million Rupiah and the income source is from business profit.

There is a possibility with the wrong information the user provided.

However, we just leave it as is for now and take notes just in case we might need some

adjustments prior to building the model.

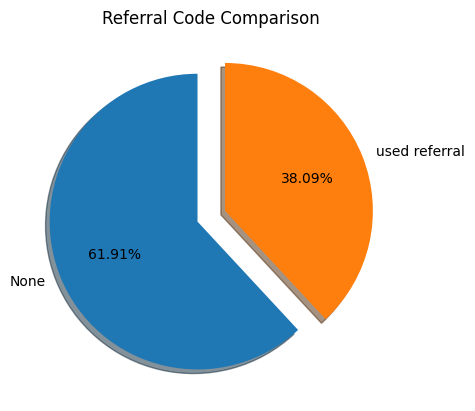

The next thing we want to check is how many per cent of our users registered using referral codes.

This might also will help to decide what type of campaign approach to increase the registration

number.

referral_code = user[['user_id', 'referral_code_used']].groupby('referral_code_used').count()

plt.pie(referral_code.user_id, labels=referral_code.index, startangle=90, shadow=True,explode=(0.1, 0.1), autopct='%1.2f%%')

plt.title('Referral Code Comparison')

plt.show()

We can see from the referral code comparison that only 38.09% of our users use referral codes during their registration process.

We can create an announcement on the company website or application about bonus credit if the users refer some friends to register with us.

This will increase the number of new users, and transactions, and also a cheaper version of the advertisement as we announce it using our private platform so third-party advertisement costs are needed.

As well as encourage the current users to make more transactions using the bonus credit and so on.

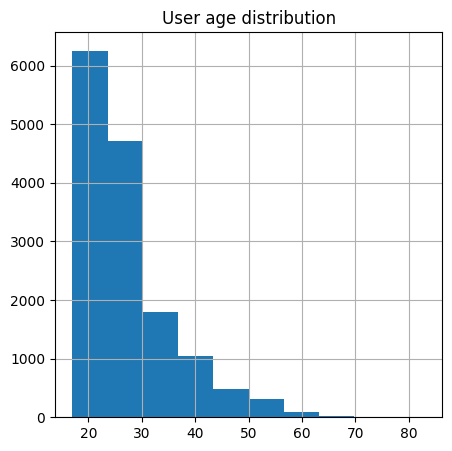

We will check the average age of our users.

user['user_age'].describe()

count 14712.000000

mean 27.176591

std 8.552585

min 17.000000

25% 21.000000

50% 25.000000

75% 31.000000

max 83.000000

Name: user_age, dtype: float64The description shows that the average age of our users is 27 years old. The youngest is 17 and the oldest is 83 years old.

We will try to visualise its distribution of it by using the histogram.

user['user_age'].hist(figsize = (5,5))

plt.title('User age distribution')

The histogram shows that most of our users are in the age group 20's and 30's.

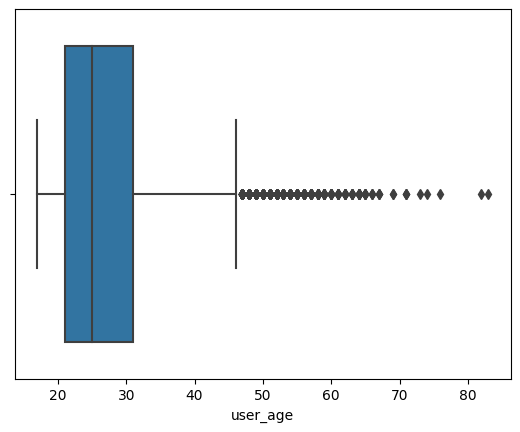

The next step we will do is to use zscore to calculate if there are any outliers.

mean = np.mean(user.user_age)

std = np.std(user.user_age)

outlier = []

for i in user.user_age:

z = (i-mean)/std

if z > 3:

outlier.append(i)

print('outliers in dataset are', set(outlier))

sns.boxplot(x=user.user_age)

outliers in dataset are {53, 54, 55, 56, 57, 58, 59, 60, 61, 62, 63, 64, 65, 66, 67, 69, 71, 73, 74, 76, 82, 83}

The z-score calculation, shows the outliers from the user's age are 53 years and older.

We will visualise the distribution and check how many users are in the outliers then merge dataset 1 and the transactions' dataset to see how many percentages of the outlier's users contribute to the transaction before we decide to remove the outliers or just leave it as is.

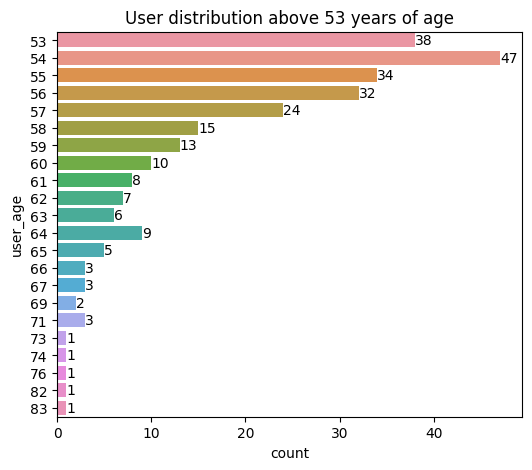

user_outliers = user.loc[user.user_age>=53,:]

total_out = user_outliers.user_id.count()

percentage_outliers = (total_out/total_user)

print(f'Total users in outliers : {total_out} OR {percentage_outliers:.2%} from total user')

fig, ax = plt.subplots(figsize=(6, 5))

ax = sns.countplot(y= user_outliers.user_age, data = user_outliers)

ax.set_title('User distribution above 53 years of age')

for x in ax.containers:

ax.bar_label(x, label_type='edge')

plt.show()

Total users in outliers : 264 OR 1.79% from total user

The chart above shows that we have a total of 264 users in the outliers category or equal to 1.79% of the total user.

With the highest distribution at 54 years of age and the lowest starting from 73 years. Since the age outliers are still in the normal scope, we will keep the users 54 years of age and older included in our analysis.

Transactions

We want to check how many rows of data we have on the transactions' dataset and the total number of users that making transactions.

print(f'Total rows: {trans.shape[0]} ,columns: {trans.shape[1]}')

transcation_users = trans['user_id'].nunique()

print(f'Total users making transaction period August - October 2021 = {transcation_users} users

or {(transcation_users/total_user):.2%}')

trans.info()

Total rows: 158811 ,columns: 14

Total users making transaction period August - October 2021 = 8277 users or 56.26%

RangeIndex: 158811 entries, 0 to 158810

Data columns (total 14 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 user_id 158811 non-null int64

1 date 158811 non-null object

2 Saham_AUM 106292 non-null float64

3 Saham_invested_amount 106292 non-null float64

4 Saham_transaction_amount 100839 non-null float64

5 Pasar_Uang_AUM 131081 non-null float64

6 Pasar_Uang_invested_amount 131081 non-null float64

7 Pasar_Uang_transaction_amount 124273 non-null float64

8 Pendapatan_Tetap_AUM 105946 non-null float64

9 Pendapatan_Tetap_invested_amount 105946 non-null float64

10 Pendapatan_Tetap_transaction_amount 100497 non-null float64

11 Campuran_AUM 5352 non-null float64

12 Campuran_invested_amount 5352 non-null float64

13 Campuran_transaction_amount 5117 non-null float64

dtypes: float64(12), int64(1), object(1)From the data description above, we can see that there are 158811 rows and 14 columns of data in the transactions' dataset.

Furthermore, it's only 8277 users made transactions or equal to 56.26% of the total users.

The company can create some campaigns to encourage new users to make new transactions.

In addition, we can see from the data information we have plenty of columns containing the null value.

We will check to confirm this information and change the 'date' column name to trans_date to avoid ambiguity with the method.

trans.rename(columns={"date": "trans_date"}, inplace=True)

trans['trans_date'] = pd.to_datetime(trans['trans_date'])

trans.isnull().sum()

user_id 0

trans_date 0

Saham_AUM 52519

Saham_invested_amount 52519

Saham_transaction_amount 57972

Pasar_Uang_AUM 27730

Pasar_Uang_invested_amount 27730

Pasar_Uang_transaction_amount 34538

Pendapatan_Tetap_AUM 52865

Pendapatan_Tetap_invested_amount 52865

Pendapatan_Tetap_transaction_amount 58314

Campuran_AUM 153459

Campuran_invested_amount 153459

Campuran_transaction_amount 153694

dtype: int64The information above confirmed our findings and referring to the dataset information all of the columns with the null value is a transactions columns.

So, we will be changing the data to 0 instead of null.

trans.fillna(0, inplace=True)

trans.isnull().sum()

user_id 0

trans_date 0

Saham_AUM 0

Saham_invested_amount 0

Saham_transaction_amount 0

Pasar_Uang_AUM 0

Pasar_Uang_invested_amount 0

Pasar_Uang_transaction_amount 0

Pendapatan_Tetap_AUM 0

Pendapatan_Tetap_invested_amount 0

Pendapatan_Tetap_transaction_amount 0

Campuran_AUM 0

Campuran_invested_amount 0

Campuran_transaction_amount 0

dtype: int64The null value has been replaced, in the next step, we will find how many times a transaction has been made by the user.

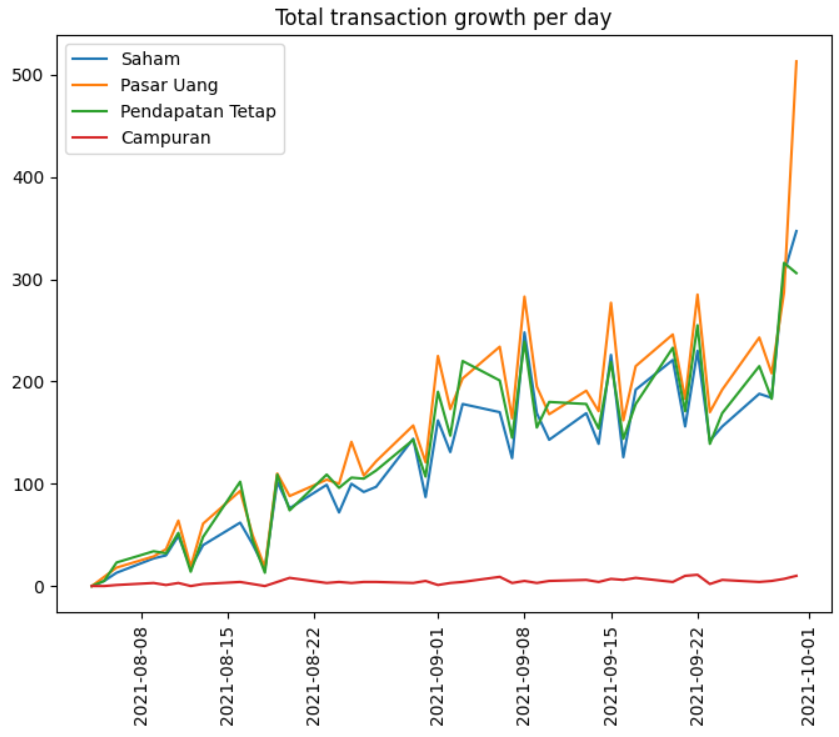

We will create some boolean flag column 1 if the user making a transaction on certain dates, and 0 if not. Later we will visualise this column to see the daily growth.

trans['count_saham'] = np.where(trans['Saham_transaction_amount']!=0.00,1,0)

trans['count_uang'] = np.where(trans['Pasar_Uang_transaction_amount']!=0.00,1,0)

trans['count_fixed'] = np.where(trans['Pendapatan_Tetap_transaction_amount']!=0.00,1,0)

trans['count_mixed'] = np.where(trans['Campuran_transaction_amount']!=0.00,1,0)

trans_count = trans[['count_saham', 'count_uang', 'count_fixed', 'count_mixed', 'trans_date']].groupby('trans_date').sum()

t_series = trans_count.index.to_pydatetime()

fig, ax = plt.subplots(figsize=(8, 6))

ax.plot(t_series, trans_count)

plt.title('Total transaction growth per day')

plt.legend(['Saham', 'Pasar Uang', 'Pendapatan Tetap', 'Campuran'])

plt.setp(ax.xaxis.get_ticklabels(), rotation=90)

plt.show()

From the number of transactions chart, the higher type of transaction is Pasar Uang (Money Market) followed by Pendapatan Tetap (fixed income) and Saham (stocks) respectively.

As we can see from the dataset, the AUM and the invested amount is updated daily, meanwhile, transactions are filled when the users make any buy or sell transactions and it will fill with 0 if no transactions have been made.

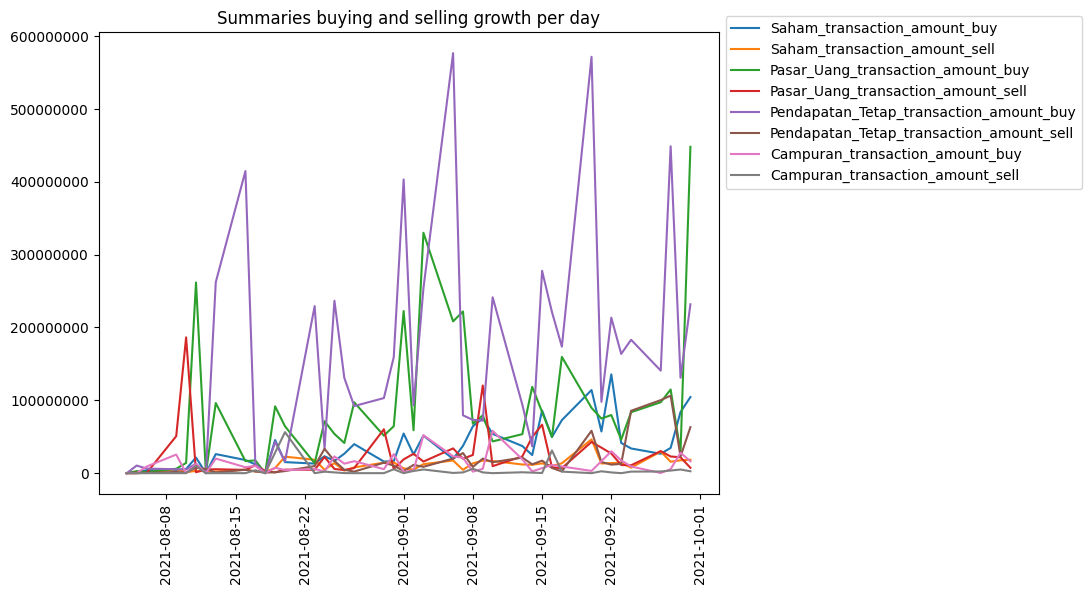

Furthermore, we will be separating buy and sell transactions into new columns, to avoid biased data when summarising the transactions.

trans_buysell = ['Saham_transaction_amount','Pasar_Uang_transaction_amount', 'Pendapatan_Tetap_transaction_amount',

'Campuran_transaction_amount']

for x in trans_buysell:

mask = trans[x] < 0

trans[x+'_buy'] = trans[x].mask(mask).abs()

trans[x+'_sell'] = trans[x].mask(~mask).abs()

trans.loc[trans.Saham_transaction_amount !=0.00,:].head()| user_id | trans_date | Saham_AUM | Saham_invested_amount | Saham_transaction_amount | Pasar_Uang_AUM | Pasar_Uang_invested_amount | Pasar_Uang_transaction_amount | Pendapatan_Tetap_AUM | Pendapatan_Tetap_invested_amount | ... | count_fixed | count_mixed | Saham_transaction_amount_buy | Saham_transaction_amount_sell | Pasar_Uang_transaction_amount_buy | Pasar_Uang_transaction_amount_sell | Pendapatan_Tetap_transaction_amount_buy | Pendapatan_Tetap_transaction_amount_sell | Campuran_transaction_amount_buy | Campuran_transaction_amount_sell | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 25 | 50961 | 2021-09-01 | 1705566.0 | 1700000.0 | 1000000.0 | 100065.0 | 100000.0 | 0.0 | 200124.0 | 200000.0 | ... | 0 | 0 | 1000000.0 | NaN | 0.0 | NaN | 0.0 | NaN | 0.0 | NaN |

| 46 | 50961 | 2021-09-30 | 2063909.0 | 2000000.0 | 300000.0 | 700603.0 | 700000.0 | 600000.0 | 1398998.0 | 1400000.0 | ... | 1 | 0 | 300000.0 | NaN | 600000.0 | NaN | 1200000.0 | NaN | 0.0 | NaN |

| 102 | 61414 | 2021-08-13 | 0.0 | 0.0 | -10000.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | ... | 0 | 0 | NaN | 10000.0 | 0.0 | NaN | 0.0 | NaN | 0.0 | NaN |

| 154 | 66145 | 2021-09-29 | 248015.0 | 240000.0 | 140000.0 | 29992.0 | 30000.0 | 0.0 | 129929.0 | 130000.0 | ... | 0 | 0 | 140000.0 | NaN | 0.0 | NaN | 0.0 | NaN | 0.0 | NaN |

| 166 | 67251 | 2021-09-20 | 562777.0 | 570000.0 | 530000.0 | 110065.0 | 110000.0 | 100000.0 | 420268.0 | 420000.0 | ... | 1 | 0 | 530000.0 | NaN | 100000.0 | NaN | 370000.0 | NaN | 0.0 | NaN |

5 rows × 26 columns

Since we split the transactions into buy and sell, we will drop the original

transaction column.

trans.drop(trans_buysell, axis=1, inplace=True)

trans.head()| user_id | trans_date | Saham_AUM | Saham_invested_amount | Pasar_Uang_AUM | Pasar_Uang_invested_amount | Pendapatan_Tetap_AUM | Pendapatan_Tetap_invested_amount | Campuran_AUM | Campuran_invested_amount | ... | count_fixed | count_mixed | Saham_transaction_amount_buy | Saham_transaction_amount_sell | Pasar_Uang_transaction_amount_buy | Pasar_Uang_transaction_amount_sell | Pendapatan_Tetap_transaction_amount_buy | Pendapatan_Tetap_transaction_amount_sell | Campuran_transaction_amount_buy | Campuran_transaction_amount_sell | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 50701 | 2021-08-30 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 10132277.0 | 10000000.0 | ... | 0 | 0 | 0.0 | NaN | 0.0 | NaN | 0.0 | NaN | 0.0 | NaN |

| 1 | 50701 | 2021-08-31 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 10206945.0 | 10000000.0 | ... | 0 | 0 | 0.0 | NaN | 0.0 | NaN | 0.0 | NaN | 0.0 | NaN |

| 2 | 50701 | 2021-09-01 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 9956556.0 | 10000000.0 | ... | 0 | 0 | 0.0 | NaN | 0.0 | NaN | 0.0 | NaN | 0.0 | NaN |

| 3 | 50701 | 2021-09-02 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 9914858.0 | 10000000.0 | ... | 0 | 0 | 0.0 | NaN | 0.0 | NaN | 0.0 | NaN | 0.0 | NaN |

| 4 | 50701 | 2021-09-03 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 10016360.0 | 10000000.0 | ... | 0 | 0 | 0.0 | NaN | 0.0 | NaN | 0.0 | NaN | 0.0 | NaN |

5 rows × 22 columns

The next thing is we will visualise the buy-sell transactions to see the total amount of transactions growth.

buysell = trans[['Saham_transaction_amount_buy', 'Saham_transaction_amount_sell', 'Pasar_Uang_transaction_amount_buy', 'Pasar_Uang_transaction_amount_sell',

'Pendapatan_Tetap_transaction_amount_buy', 'Pendapatan_Tetap_transaction_amount_sell','Campuran_transaction_amount_buy', 'Campuran_transaction_amount_sell',

'trans_date']].groupby('trans_date').sum()

t_series = buysell.index.to_pydatetime()

fig, ax = plt.subplots(figsize=(8, 6))

ax.plot(t_series, buysell)

plt.title('Summaries buying and selling growth per day')

ax.legend(['Saham_transaction_amount_buy', 'Saham_transaction_amount_sell', 'Pasar_Uang_transaction_amount_buy', 'Pasar_Uang_transaction_amount_sell',

'Pendapatan_Tetap_transaction_amount_buy', 'Pendapatan_Tetap_transaction_amount_sell','Campuran_transaction_amount_buy', 'Campuran_transaction_amount_sell'],

bbox_to_anchor=(1,1.05))

plt.setp(ax.xaxis.get_ticklabels(), rotation=90)

plt.ticklabel_format(style='plain', axis='y')

plt.show()

The summaries buying and selling chart shows that the total amount of Pendapatan Tetap (Buying) and Pasar Uang (Buying) are leading than other transactions.

We are also can see that the majority of the transactions are buying, this could meanings that our users are more interested in investing their money.

Since invested columns are updated daily with the last balanced of the users, we will drop the duplicate data and take the latest date.

Since invested columns are updated daily with the last balanced of the users, we will drop the duplicate data and take the latest date.

invested_col = ['user_id', 'trans_date', 'Saham_AUM', 'Saham_invested_amount', 'Pasar_Uang_AUM',

'Pasar_Uang_invested_amount', 'Pendapatan_Tetap_AUM', 'Pendapatan_Tetap_invested_amount', 'Campuran_AUM',

'Campuran_invested_amount']

invested_AUM = trans.sort_values(by='trans_date').drop_duplicates(subset=['user_id'], keep='last').reset_index(drop=True)

invested_AUM = invested_AUM[invested_col].copy()

print(f'Total rows: {invested_AUM.shape[0]}, columns: {invested_AUM.shape[1]}\nInvested:')

invested_AUM.head()

Total rows: 8277, columns: 10

Invested:| user_id | trans_date | Saham_AUM | Saham_invested_amount | Pasar_Uang_AUM | Pasar_Uang_invested_amount | Pendapatan_Tetap_AUM | Pendapatan_Tetap_invested_amount | Campuran_AUM | Campuran_invested_amount | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 3786300 | 2021-09-30 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 1 | 3760891 | 2021-09-30 | 258975.00 | 249864.00 | 0.00 | 0.00 | 553302.00 | 550000.00 | 0.00 | 0.00 |

| 2 | 4096532 | 2021-09-30 | 13803192.00 | 13352136.00 | 2390277.00 | 2387932.00 | 8134491.00 | 8149154.00 | 0.00 | 0.00 |

| 3 | 2836295 | 2021-09-30 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 4 | 2839273 | 2021-09-30 | 0.00 | 0.00 | 10028.00 | 10000.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Transactions dataframe:

sum_trans_total = trans.groupby('user_id')[['Saham_transaction_amount_buy',

'Saham_transaction_amount_sell', 'Pasar_Uang_transaction_amount_buy',

'Pasar_Uang_transaction_amount_sell',

'Pendapatan_Tetap_transaction_amount_buy',

'Pendapatan_Tetap_transaction_amount_sell',

'Campuran_transaction_amount_buy', 'Campuran_transaction_amount_sell',

'count_saham', 'count_uang', 'count_fixed', 'count_mixed']].sum()

print(f'Total rows:{sum_trans_total.shape[0]}, columns: {sum_trans_total.shape[1]}\nTransactions:')

sum_trans_total.head()

Total rows:8277, columns: 12

Transactions:| Saham_transaction_amount_buy | Saham_transaction_amount_sell | Pasar_Uang_transaction_amount_buy | Pasar_Uang_transaction_amount_sell | Pendapatan_Tetap_transaction_amount_buy | Pendapatan_Tetap_transaction_amount_sell | Campuran_transaction_amount_buy | Campuran_transaction_amount_sell | count_saham | count_uang | count_fixed | count_mixed | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| user_id | ||||||||||||

| 50701 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0 | 0 | 0 |

| 50961 | 1300000.00 | 0.00 | 600000.00 | 0.00 | 1200000.00 | 0.00 | 0.00 | 0.00 | 2 | 1 | 1 | 0 |

| 53759 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0 | 0 | 0 |

| 54759 | 0.00 | 0.00 | 2000000.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 1 | 0 | 0 |

| 61414 | 0.00 | 10000.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1 | 0 | 0 | 0 |

After creating the invested and transactions dataframe, then we will merge both

dataframe into new_trans and we will be using this dataset in the future.

new_trans = invested_AUM.merge(sum_trans_total, on='user_id')

print(f'Total rows: {new_trans.shape[0]}, columns:{new_trans.shape[1]}')

del invested_AUM, sum_trans_total

new_trans.head()

Total rows: 8277, columns:22| user_id | trans_date | Saham_AUM | Saham_invested_amount | Pasar_Uang_AUM | Pasar_Uang_invested_amount | Pendapatan_Tetap_AUM | Pendapatan_Tetap_invested_amount | Campuran_AUM | Campuran_invested_amount | ... | Pasar_Uang_transaction_amount_buy | Pasar_Uang_transaction_amount_sell | Pendapatan_Tetap_transaction_amount_buy | Pendapatan_Tetap_transaction_amount_sell | Campuran_transaction_amount_buy | Campuran_transaction_amount_sell | count_saham | count_uang | count_fixed | count_mixed | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 3786300 | 2021-09-30 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 10000.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1 | 1 | 0 | 0 |

| 1 | 3760891 | 2021-09-30 | 258975.00 | 249864.00 | 0.00 | 0.00 | 553302.00 | 550000.00 | 0.00 | 0.00 | ... | 310000.00 | 410000.00 | 499783.00 | 49783.00 | 0.00 | 0.00 | 5 | 7 | 7 | 0 |

| 2 | 4096532 | 2021-09-30 | 13803192.00 | 13352136.00 | 2390277.00 | 2387932.00 | 8134491.00 | 8149154.00 | 0.00 | 0.00 | ... | 1937932.00 | 0.00 | 6619154.00 | 0.00 | 0.00 | 0.00 | 2 | 1 | 2 | 0 |

| 3 | 2836295 | 2021-09-30 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 100000.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1 | 1 | 0 | 0 |

| 4 | 2839273 | 2021-09-30 | 0.00 | 0.00 | 10028.00 | 10000.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 40000.00 | 0.00 | 0.00 | 1 | 0 | 1 | 0 |

The next thing we will do is to do a quick exploration of our bonds order dataset before combining it with user and transaction.

Bonds Order

print(f'Total rows: {result.shape[0]}, columns:{result.shape[1]}')

print(f'Total User: {result.user_id.nunique()}')

result.info()

Total rows: 8484, columns:3

Total User: 8484

RangeIndex: 8484 entries, 0 to 8483

Data columns (total 3 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 user_id 8484 non-null int64

1 flag_order_bond 8484 non-null int64

2 bond_units_ordered 8484 non-null int64

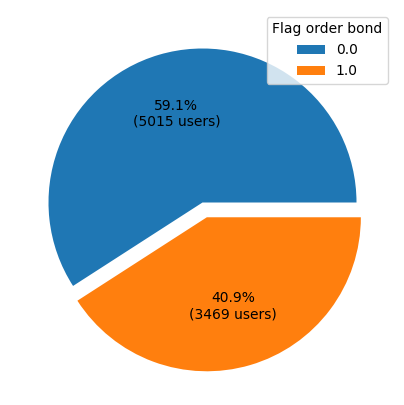

dtypes: int64(3)Since our problem statement is to find the prediction of whether the user will order bonds based on their behaviour.

We want to see the percentage that users who order bonds from the bonds order dataset to see the comparison between each class.

bond_order = result[['user_id', 'flag_order_bond']].groupby('flag_order_bond').count()

fig, ax = plt.subplots(figsize=(5, 5), subplot_kw=dict(aspect="equal"))

wedges, texts, autotexts = ax.pie(bond_order.user_id, autopct=lambda pct: func(pct, bond_order.user_id),

textprops=dict(color="black"), explode=(0,0.1))

ax.legend(wedges, bond_order.index, title='Flag order bond', loc='upper right')

plt.show()

bond_chart=sns.countplot(x=result["flag_order_bond"])

plt.tight_layout()

plt.show()

It shows that only 40.9% of our users order Government Bonds. However, we found a difference in our number of users from the transactions' dataset and 3. We have 8277 total users in the transactions dataset that makes transactions, meanwhile, 8484 users in the bonds order dataset.

We will combine the transactions' dataset and bonds in order to see the details of it.

trans_3 = result.merge(new_trans, how='left')

print(f'Total combined rows: {trans_3.shape[0]}, columns:{trans_3.shape[1]}')

print(f'Difference total users:{trans_3.user_id.nunique()-transaction_users}')

trans_3.isnull().sum() Total combined rows: 8484, columns:24

Difference total users:207

user_id 0

flag_order_bond 0

bond_units_ordered 0

trans_date 207

Saham_AUM 207

Saham_invested_amount 207

Pasar_Uang_AUM 207

Pasar_Uang_invested_amount 207

Pendapatan_Tetap_AUM 207

Pendapatan_Tetap_invested_amount 207

Campuran_AUM 207

Campuran_invested_amount 207

Saham_transaction_amount 207

Pasar_Uang_transaction_amount 207

Pendapatan_Tetap_transaction_amount 207

Campuran_transaction_amount 207

dtype: int64We left joined our dataset since our bonds order dataset has more rows of data for a better understanding what is the difference.

There are 8484 rows of data and 16 columns after the merging. We also check how much the difference between the dataset and the null value.

Our difference number of users between the transactions' dataset and 3 is 207 users, it is also the same as the number of our null values.

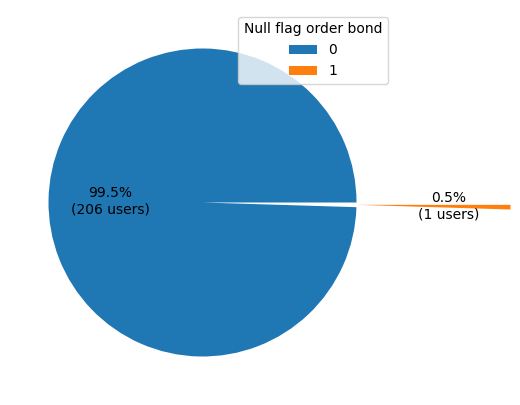

We will try to visualise the user with null values if they ordered bonds or not before we decide to exclude those users.

v = trans_3[trans_3.isnull().any(axis=1)]

v_null = v[['user_id', 'flag_order_bond']].groupby('flag_order_bond').count()

fig, ax = plt.subplots(figsize=(5, 5), subplot_kw=dict(aspect="equal"))

wedges, texts, autotexts = ax.pie(v_null.user_id, autopct=lambda pct: func(pct, v_null.user_id),

textprops=dict(color="black"), explode=(0,1))

ax.legend(wedges, v_null.index, title='Null flag order bond', loc='upper right')

plt.show()

From the pie chart, we can see only 1 of 207 users ended up ordering bonds from the company.

Since we don't have any transactional records for the 207 users, it is safe to exclude them from our analysis.

Now, we will merge all of our datasets into 1 before we preprocess our data for modelling.

df1 = new_trans.merge(user, how='inner', on='user_id')

full_data = df1.merge(result, how='inner', on='user_id')

print(f'Total full rows: {full_data.shape[0]}, columns:{full_data.shape[1]}')

print('Null Values:')

full_data.isnull().sum() Total full rows: 8277, columns:32

Null Values:

user_id 0

trans_date 0

Saham_AUM 0

Saham_invested_amount 0

Pasar_Uang_AUM 0

Pasar_Uang_invested_amount 0

Pendapatan_Tetap_AUM 0

Pendapatan_Tetap_invested_amount 0

Campuran_AUM 0

Campuran_invested_amount 0

Saham_transaction_amount_buy 0

Saham_transaction_amount_sell 0

Pasar_Uang_transaction_amount_buy 0

Pasar_Uang_transaction_amount_sell 0

Pendapatan_Tetap_transaction_amount_buy 0

Pendapatan_Tetap_transaction_amount_sell 0

Campuran_transaction_amount_buy 0

Campuran_transaction_amount_sell 0

count_saham 0

count_uang 0

count_fixed 0

count_mixed 0

registration_import_datetime 0

user_gender 0

user_age 0

user_occupation 0

user_income_range 0

referral_code_used 0

user_income_source 0

registration_month 0

flag_order_bond 0

bond_units_ordered 0

dtype: int64After we combined the 3 datasets, we have a total of 8277 rows of data and 32 columns.

We will create an age group bin into 17-19,20-29,30-39 and so on instead of user_age.

bins = [17, 20, 30, 40, 50, 60, 70, 80, 100]

labels = ['17-19','20-29','30-39', '40-49', '50-59', '60-69', '70-79', '80+']

full_data['age_group'] = pd.cut(full_data['user_age'], bins, labels = labels,include_lowest = True)

full_data.drop(['user_age'], axis=1, inplace=True)

full_data.age_group.unique()

['20-29', '40-49', '30-39', '50-59', '17-19', '60-69', '70-79', '80+']

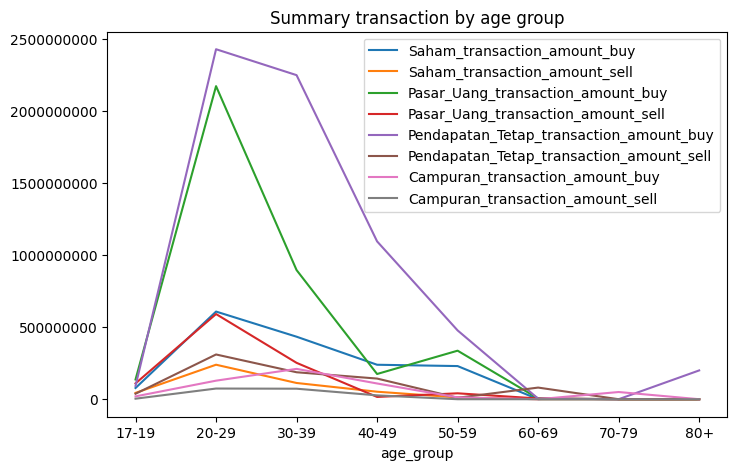

Categories (8, object): ['17-19' < '20-29' < '30-39' < '40-49' < '50-59' < '60-69' < '70-79' < '80+']trans_group = full_data[['age_group', 'Saham_transaction_amount_buy',

'Saham_transaction_amount_sell', 'Pasar_Uang_transaction_amount_buy',

'Pasar_Uang_transaction_amount_sell',

'Pendapatan_Tetap_transaction_amount_buy',

'Pendapatan_Tetap_transaction_amount_sell',

'Campuran_transaction_amount_buy', 'Campuran_transaction_amount_sell']].groupby('age_group').sum()

trans_group.plot(title='Summary transaction by age group', figsize=(8,5))

plt.ticklabel_format(axis='y', style='plain')

plt.show()

When we visualise the number of transactions mapped with the age group, we can see that the age group 20-29 years old contribute the most transactions, and it started to slow down until the user aged.

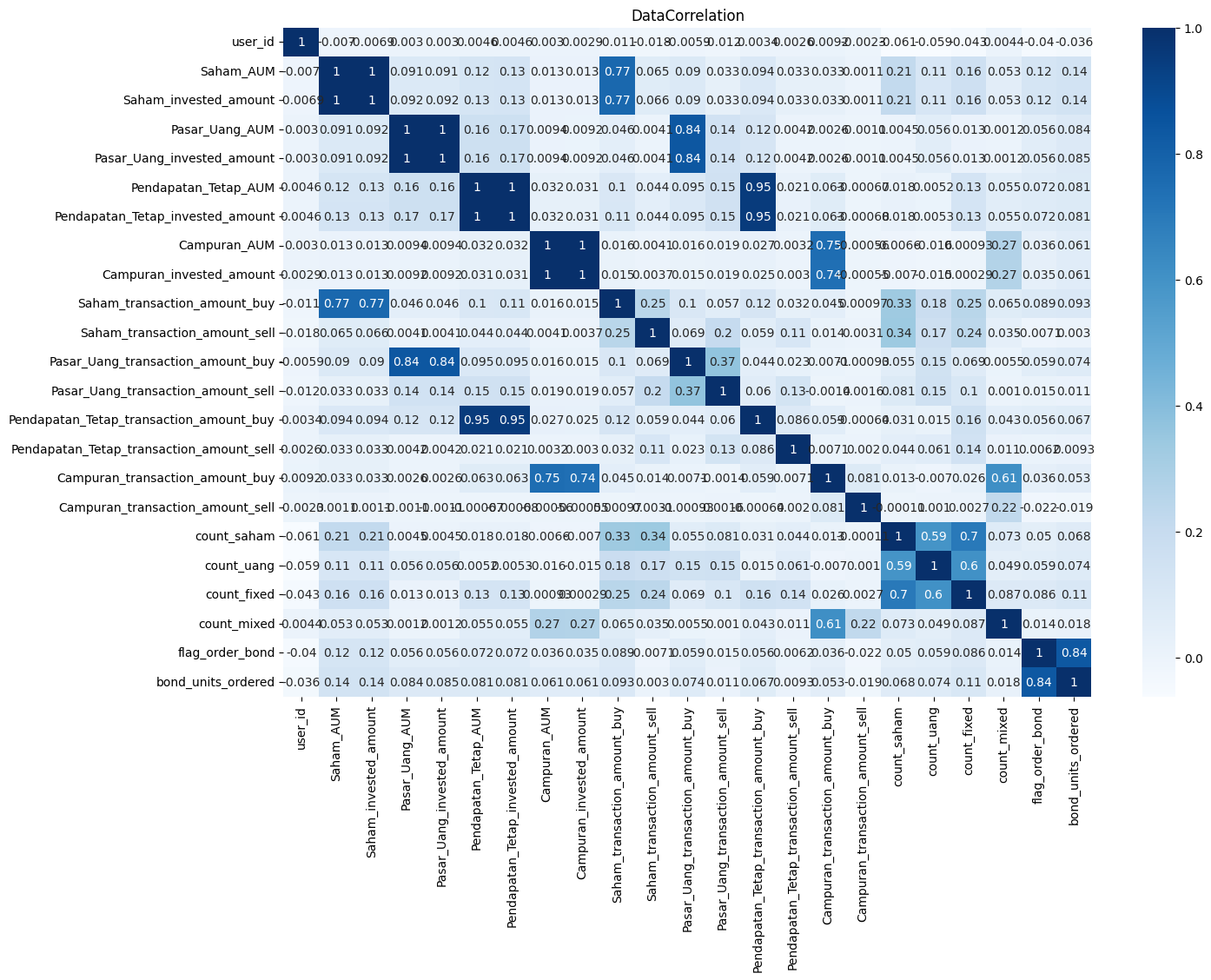

Then we will check the correlation from each of our features by plotting the correlation matrix.

Then we will check the correlation from each of our features by plotting the correlation matrix.

fig, ax = plt.subplots(figsize=(25,10))

sns.heatmap(full_data.corr(), annot = True, ax=ax, cmap = 'Blues')

plt.title("DataCorrelation")

plt.show()

The correlation matrix shows that AUM and Invested column has a perfect positive correlation between each other as well as buying transactions.

Furthermore, bond_units_ordered also has a positive correlation with flag_order_bond. So, we will be dropping one of the features to avoid multicollinearity in the model performance.

pos_corr = ['Saham_AUM', 'Pasar_Uang_AUM', 'Pendapatan_Tetap_AUM', 'Campuran_AUM', 'Saham_transaction_amount_buy',

'Pasar_Uang_transaction_amount_buy', 'Pendapatan_Tetap_transaction_amount_buy', 'Campuran_transaction_amount_buy',

'bond_units_ordered']

full_data.drop(pos_corr, axis=1, inplace=True)Preprocessing

So, we will convert our categorical data into numerical. We will print out the unique value from non-numerical data.

Moreover, we will remove the column transaction date, registration month, and user id.

for x in full_data:

uniqueValues = full_data[x].unique()

n_values = len(uniqueValues)

if full_data[x].dtypes == object:

print(f'Column: {x} -- total unique value: ({n_values}) {uniqueValues}')

Column: user_gender -- total unique value: (2) ['Male' 'Female']

Column: user_occupation -- total unique value: (9) ['Pelajar' 'Swasta' 'Others' 'Pengusaha' 'IRT' 'Guru' 'Pensiunan' 'PNS'

'TNI/Polisi']

Column: user_income_range -- total unique value: (6) ['< 10 Juta' 'Rp 10 Juta - 50 Juta' '> Rp 100 Juta - 500 Juta'

'> Rp 500 Juta - 1 Miliar' '> Rp 50 Juta - 100 Juta' '> Rp 1 Miliar']

Column: referral_code_used -- total unique value: (2) ['used referral' 'None']

Column: user_income_source -- total unique value: (10) ['Keuntungan Bisnis' 'Gaji' 'Lainnya' 'Warisan' 'Undian'

'Dari Orang Tua / Anak' 'Tabungan' 'Hasil Investasi' 'Dari Suami / istri'

'Bunga Simpanan']From the unique value details, it clearly shows that user_income_range is an ordinal category. So we will be using a label encoder to convert them into numerical data, meanwhile one hot encoding for the rest.

full_data.drop(['trans_date', 'registration_month', 'user_id'], axis=1, inplace=True)

one_hot_var = ['user_gender','user_occupation', 'referral_code_used', 'user_income_source']

one_hot = pd.get_dummies(full_data, columns = one_hot_var)

from sklearn.preprocessing import LabelEncoder

labelencoder = LabelEncoder()

one_hot['registration_import_datetime'] = labelencoder.fit_transform(one_hot['registration_import_datetime'])

one_hot['age_group'] = labelencoder.fit_transform(one_hot['age_group'])

one_hot['user_income_range'] = labelencoder.fit_transform(one_hot['user_income_range'])

one_hot.info()

Int64Index: 8277 entries, 0 to 8276

Data columns (total 39 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Saham_invested_amount 8277 non-null float64

1 Pasar_Uang_invested_amount 8277 non-null float64

2 Pendapatan_Tetap_invested_amount 8277 non-null float64

3 Campuran_invested_amount 8277 non-null float64

4 Saham_transaction_amount_sell 8277 non-null float64

5 Pasar_Uang_transaction_amount_sell 8277 non-null float64

6 Pendapatan_Tetap_transaction_amount_sell 8277 non-null float64

7 Campuran_transaction_amount_sell 8277 non-null float64

8 count_saham 8277 non-null int32

9 count_uang 8277 non-null int32

10 count_fixed 8277 non-null int32

11 count_mixed 8277 non-null int32

12 registration_import_datetime 8277 non-null int32

13 user_income_range 8277 non-null int32

14 flag_order_bond 8277 non-null int64

15 age_group 8277 non-null int32

16 user_gender_Female 8277 non-null uint8

17 user_gender_Male 8277 non-null uint8

18 user_occupation_Guru 8277 non-null uint8

19 user_occupation_IRT 8277 non-null uint8

20 user_occupation_Others 8277 non-null uint8

21 user_occupation_PNS 8277 non-null uint8

22 user_occupation_Pelajar 8277 non-null uint8

23 user_occupation_Pengusaha 8277 non-null uint8

24 user_occupation_Pensiunan 8277 non-null uint8

25 user_occupation_Swasta 8277 non-null uint8

26 user_occupation_TNI/Polisi 8277 non-null uint8

27 referral_code_used_None 8277 non-null uint8

28 referral_code_used_used referral 8277 non-null uint8

29 user_income_source_Bunga Simpanan 8277 non-null uint8

30 user_income_source_Dari Orang Tua / Anak 8277 non-null uint8

31 user_income_source_Dari Suami / istri 8277 non-null uint8

32 user_income_source_Gaji 8277 non-null uint8

33 user_income_source_Hasil Investasi 8277 non-null uint8

34 user_income_source_Keuntungan Bisnis 8277 non-null uint8

35 user_income_source_Lainnya 8277 non-null uint8

36 user_income_source_Tabungan 8277 non-null uint8

37 user_income_source_Undian 8277 non-null uint8

38 user_income_source_Warisan 8277 non-null uint8 After we convert our non-numerical data into numeric, we can see our dataset shape is changed to 8277 rows and 39 columns.

We will use the current feature to create our model using multiple classification algorithms and evaluate which one gives the best performance.

So, we will take out the target variable which is flag_order_bond from our dataset and divide them into training (60% of total data) and 40% for validation and testing.

Also, we will scale our data between 0 and 1 using minmaxscaler from scikit-learn.

x_v1 = one_hot.drop(['flag_order_bond'], axis=1)

y_v1 = one_hot['flag_order_bond'].copy()

Function to split data into train, val and test also scalingfrom sklearn.model_selection import train_test_split

from sklearn.preprocessing import MinMaxScaler

def split_scaled(x,y):

xtrain, xtemp, ytrain, ytemp = train_test_split(x, y, train_size=0.6, random_state=3)

xvalid, xtest, yvalid, ytest = train_test_split(xtemp, ytemp, test_size=0.5, random_state=3)

scale = MinMaxScaler()

xtrain_scaled = scale.fit_transform(xtrain)

xvalid_scaled = scale.fit_transform(xvalid)

xtest_scaled = scale.fit_transform(xtest)

return xtrain_scaled, ytrain, xvalid_scaled, yvalid, xtest_scaled, ytest

Function to evaluate modelsfrom sklearn.metrics import ConfusionMatrixDisplay, accuracy_score

from sklearn.metrics import confusion_matrix, roc_auc_score, roc_curve, log_loss

score_comp = []

def eval(model, name, x1, y1, x2, y2, x3,y3):

#accuracy score

predtrain = model.predict(x1)

predvalid = model.predict(x2)

predtest = model.predict(x3)

acctest = (accuracy_score(y3, predtest))

accvalid = (accuracy_score(y2, predvalid))

acctrain = (accuracy_score(y1, predtrain))

overfit = acctrain - acctest

tn, fp, fn, tp = confusion_matrix(y3, predtest).ravel()

precision1 = (tp / (tp+fp))

precision0 = (tn/(tn+fn))

recall1 = (tp/(tp+fn))

recall0 = (tn/(tn+fp))

f1 = 2*(precision1 * recall1)/(precision1 + recall1)

#log loss

logtest = log_loss(y3,predtest)

logtrain = log_loss(y1,predtrain)

#roc auc score

test_prob = model.predict_proba(x3)[::,1]

train_prob = model.predict_proba(x1)[::,1]

roctest = (roc_auc_score(y3, test_prob))

roctrain = (roc_auc_score(y1, train_prob))

fpr_test, tpr_test, _ = roc_curve(y3, test_prob)

fpr_train, tpr_train, _ = roc_curve(y1, train_prob)

#print report

print(f'Training accuracy: {acctrain:.2%} \nValidation accuracy: {accvalid:.2%}\nTesting accuracy: {acctest:.2%} \nOverfitting: {overfit:.2%}')

print(f'Log Loss Training: {logtrain}, Log Loss Testing: {logtest}')

print(f'Precision class 1: {precision1:.2%} \nPrecision class 0: {precision0:.2%}')

print(f'Recall class 1: {recall1:.2%} \nRecall class 0: {recall0:.2%}')

print(f'F1: {f1:.2%}')

print(f'ROC AUC Training: {roctrain:.2%} Testing: {roctest:.2%}')

#insert result to list for comparison

score_comp.append([name, acctrain, accvalid, acctest, overfit, precision1, precision0, recall1, recall0,

f1, logtrain, logtest, roctrain, roctest])

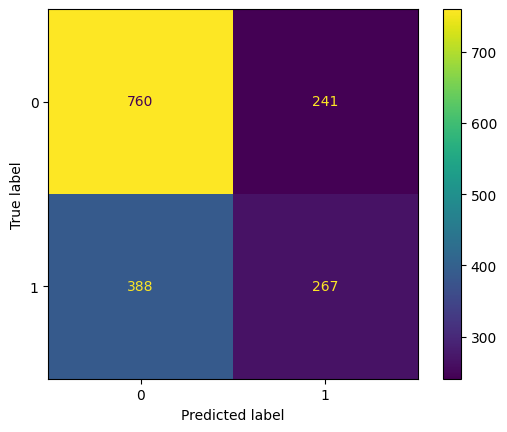

#confusion matrix plot

disp = ConfusionMatrixDisplay(confusion_matrix(y3, predtest),display_labels=model.classes_)

disp.plot()

plt.show()

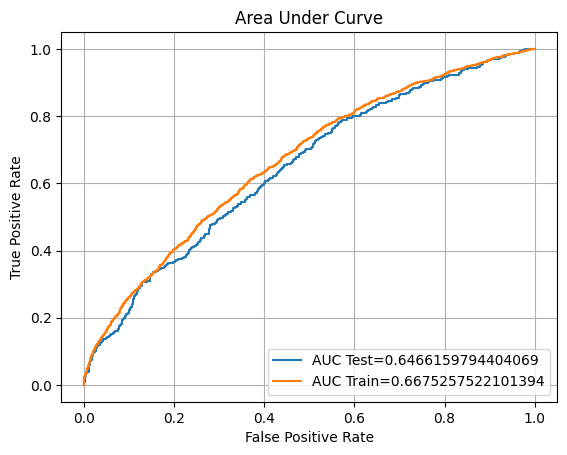

#roc auc learning curve plot

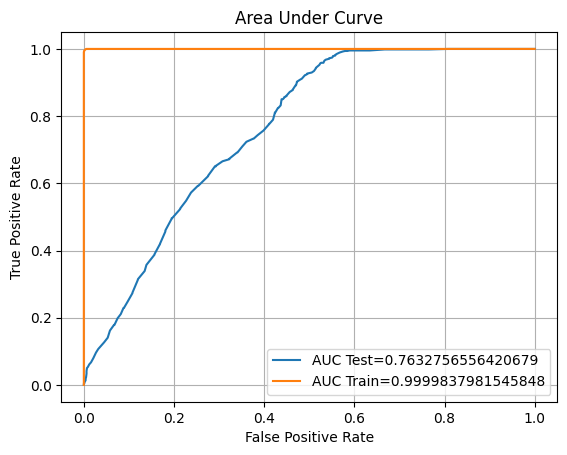

plt.title("Area Under Curve")

plt.plot(fpr_test,tpr_test,label="AUC Test="+str(roctest))

plt.plot(fpr_train,tpr_train,label="AUC Train="+str(roctrain))

plt.ylabel('True Positive Rate')

plt.xlabel('False Positive Rate')

plt.legend(loc=4)

plt.grid(True)

plt.show()

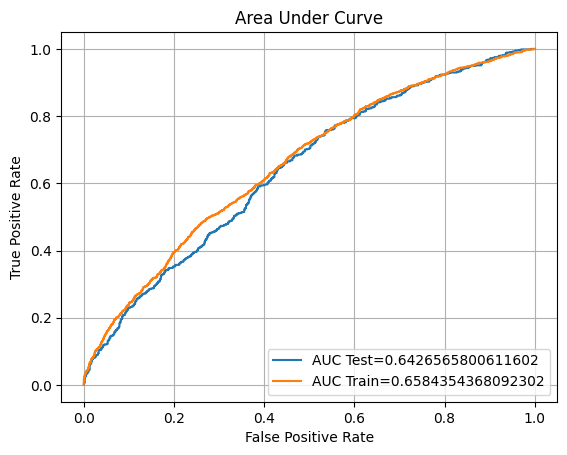

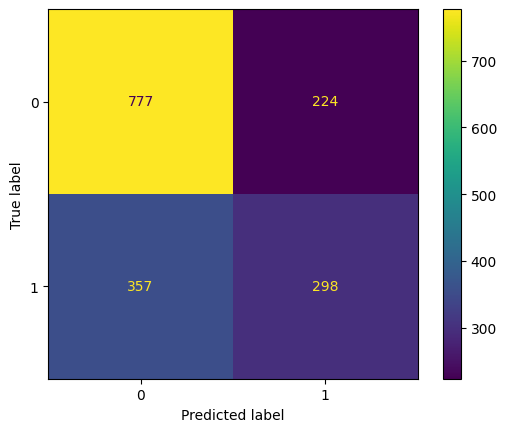

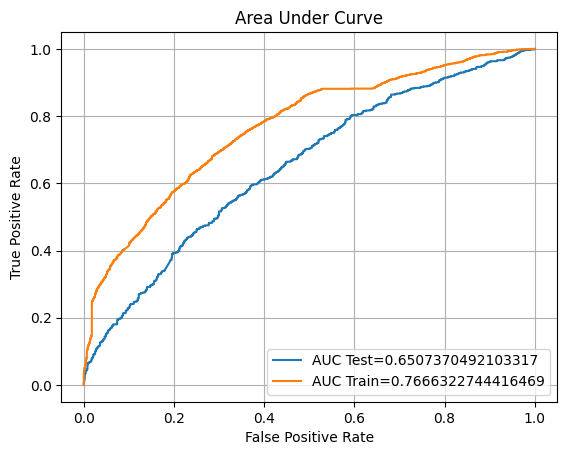

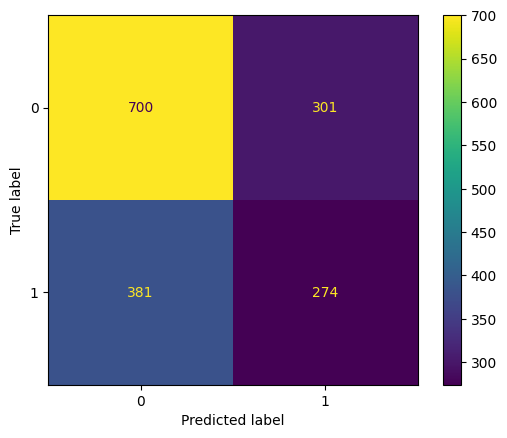

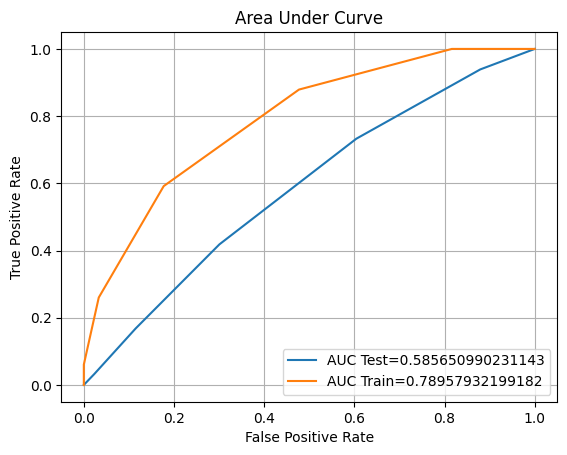

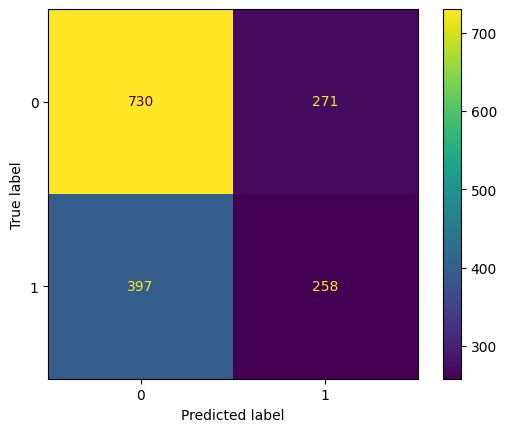

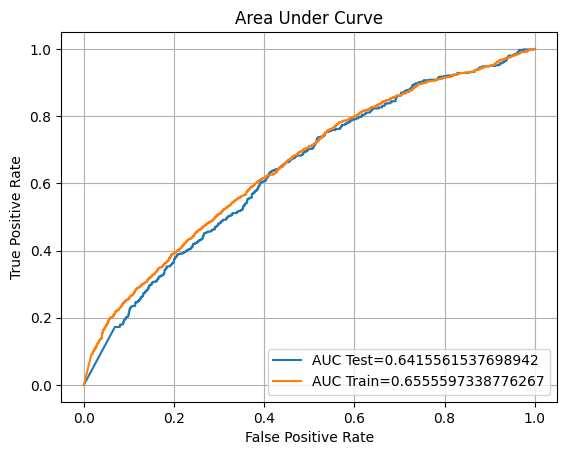

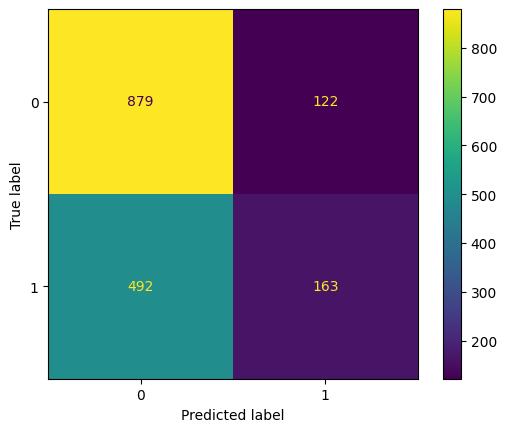

Model 1 - Logistic Regression

The first model that we will implement is using Logistic Regression with our original

dataset.

xtrain, ytrain, xvalid, yvalid, xtest, ytest = split_scaled(x_v1, y_v1)

from sklearn.linear_model import LogisticRegression

logreg = LogisticRegression()

logreg.fit(xtrain, ytrain)

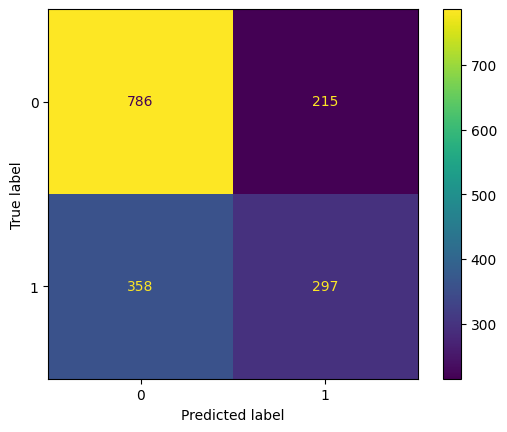

eval(logreg, 'logreg1', xtrain, ytrain, xvalid, yvalid, xtest, ytest)

Training accuracy: 63.25%

Validation accuracy: 61.51%

Testing accuracy: 62.02%

Overfitting: 1.23%

Log Loss Training: 13.246006330072253, Log Loss Testing: 13.690493950334956

Precision class 1: 52.56%

Precision class 0: 66.20%

Recall class 1: 40.76%

Recall class 0: 75.92%

F1: 45.92%

ROC AUC Training: 66.75% Testing: 64.66%

So, we can see that our model does not give a good accuracy score.

We will try to tune the model using GridSearch Cross Validation to improve the performance.

from sklearn.model_selection import GridSearchCV

log_param = [

{

'C': [0.01, 0.1, 1.0, 10, 100],

'penalty': ['l1','l2'],

'solver': ['newton-cg','saga'],

'max_iter': [200,400,600,800]

},

]

#tuned the model using gridsearch and kfold

opt_log = GridSearchCV(LogisticRegression(), param_grid = log_param, scoring='accuracy', cv=10, verbose = 2)

#fit the tuned model with training dataset

opt_log.fit(xtrain, ytrain)

print(opt_log.best_params_)

{'C': 100, 'max_iter': 800, 'penalty': 'l1', 'solver': 'saga'}We will fit our dataset to a new model with the parameters resulting from the Grid

Search.

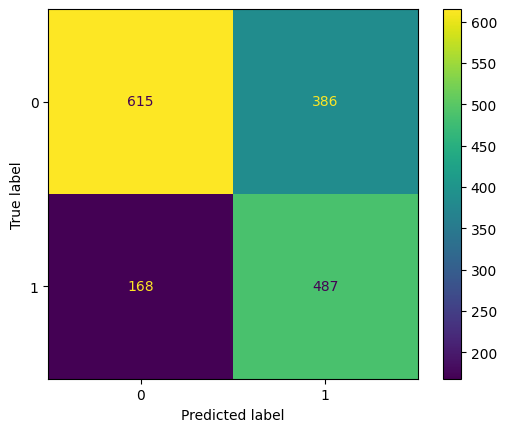

lr = LogisticRegression(C= 100, penalty= 'l1', solver= 'saga', max_iter=800)

lr.fit(xtrain, ytrain)

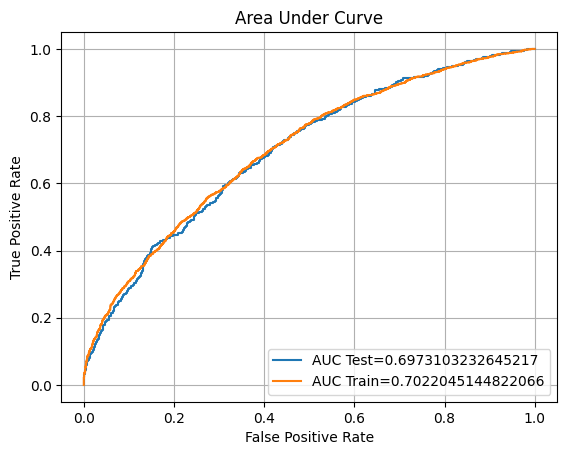

eval(lr,'logreg_tuned', xtrain, ytrain, xvalid, yvalid, xtest, ytest)

Training accuracy: 65.40%

Validation accuracy: 63.63%

Testing accuracy: 65.40%

Overfitting: 0.01%

Log Loss Training: 12.4693911644187, Log Loss Testing: 12.471626444422782

Precision class 1: 58.01%

Precision class 0: 68.71%

Recall class 1: 45.34%

Recall class 0: 78.52%

F1: 50.90%

ROC AUC Training: 70.22% Testing: 69.73%

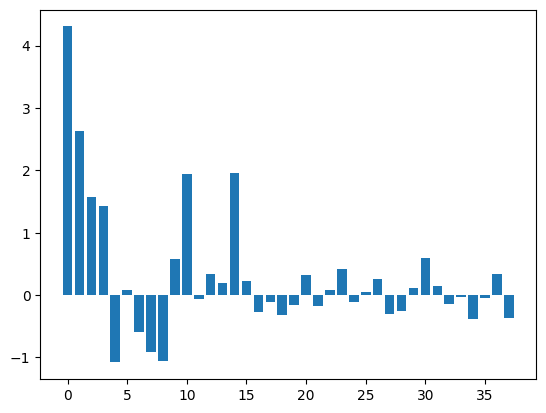

It seems the tuning increases the performance of the model. The next thing we will try to check the features coefficient and try to modify our features.

coefs_df = pd.DataFrame()

coefs_df['features'] = x_v1.columns

coefs_df['coefs'] = logreg.coef_[0]

print(coefs_df.sort_values('coefs', ascending=False).head(20))

plt.bar([x for x in range(len(coefs_df['coefs']))], coefs_df['coefs'])

plt.show()

features coefs

0 Saham_invested_amount 4.31

1 Pasar_Uang_invested_amount 2.63

14 age_group 1.95

10 count_fixed 1.94

2 Pendapatan_Tetap_invested_amount 1.58

3 Campuran_invested_amount 1.42

30 user_income_source_Dari Suami / istri 0.59

9 count_uang 0.57

23 user_occupation_Pensiunan 0.42

36 user_income_source_Undian 0.34

12 registration_import_datetime 0.33

20 user_occupation_PNS 0.32

26 referral_code_used_None 0.26

15 user_gender_Female 0.23

13 user_income_range 0.20

31 user_income_source_Gaji 0.14

29 user_income_source_Dari Orang Tua / Anak 0.12

5 Pasar_Uang_transaction_amount_sell 0.09

22 user_occupation_Pengusaha 0.08

25 user_occupation_TNI/Polisi 0.04

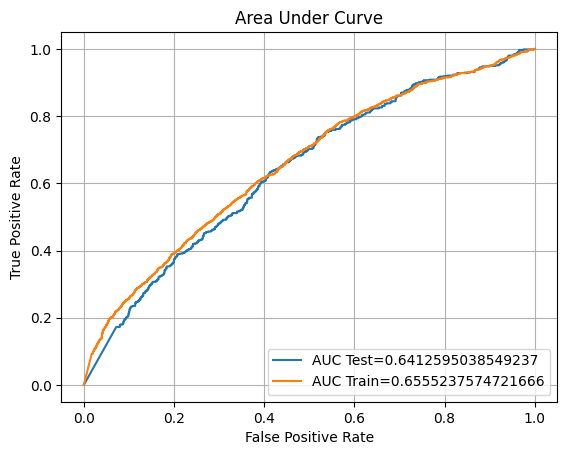

We will remove the low coefficient features that less than 0.2.

dropslv2 = coefs_df.loc[coefs_df['coefs']<0.2].features dropslv2 = dropslv2.to_list() encoded2 = one_hot.drop(dropslv2, axis=1) x_v2 = encoded2.drop(['flag_order_bond'], axis=1) y_v2 = encoded2['flag_order_bond'].copy()Fit new dataset to the modelxtrain2, ytrain2, xvalid2, yvalid2, xtest2, ytest2 = split_scaled(x_v2, y_v2) lr2 = LogisticRegression() lr2.fit(xtrain2, ytrain2) eval(lr2, 'logreg_coef', xtrain2, ytrain2, xvalid2, yvalid2, xtest2, ytest2)Training accuracy: 62.18% Validation accuracy: 61.27% Testing accuracy: 61.35% Overfitting: 0.83% Log Loss Training: 13.630684870068873, Log Loss Testing: 13.92991435328199 Precision class 1: 51.52% Precision class 0: 65.52% Recall class 1: 38.78% Recall class 0: 76.12% F1: 44.25% ROC AUC Training: 65.84% Testing: 64.27%

It seems that our previous model before removing the low coefficient features has a

better performance.

We will try to tune the model and see if the accuracy will improve.

from sklearn.model_selection import GridSearchCV

log_param = [

{

'C': [0.01, 0.1, 1.0, 10, 100],

'penalty': ['l2', 'l1'],

'solver': ['newton-cg', 'saga'],

'max_iter': [200,400,600]

},

]

#tuned the model using gridsearch and kfold

opt_log = GridSearchCV(LogisticRegression(), param_grid = log_param, scoring='accuracy', cv=10, verbose = 2)

#fit the tuned model with training dataset

opt_log.fit(xtrain2, ytrain2)

print(opt_log.best_params_) #best parameter tuning result

{'C': 100, 'max_iter': 600, 'penalty': 'l1', 'solver': 'saga'}Fit the model with new parameter from hypertuning.

lr3 = LogisticRegression(C=100, penalty='l1', solver='saga', max_iter=600)

lr3.fit(xtrain2, ytrain2)

eval(lr3, 'logreg_coef_tuned', xtrain2, ytrain2, xvalid2, yvalid2, xtest2, ytest2)

Training accuracy: 64.44%

Validation accuracy: 63.32%

Testing accuracy: 64.92%

Overfitting: -0.48%

Log Loss Training: 12.81777927611375, Log Loss Testing: 12.645750373838808

Precision class 1: 57.09%

Precision class 0: 68.52%

Recall class 1: 45.50%

Recall class 0: 77.62%

F1: 50.64%

ROC AUC Training: 69.33% Testing: 68.66%

Unfortunately, when we reduce the low coefficient features it doesn't perform better

than our previous dataset.

We will try to create a new model using different algorithms.

Model 2 - Support Vector Machine

from sklearn.svm import SVC

svm_v1 = SVC(probability=True)

svm_v1.fit(xtrain, ytrain)

eval(svm_v1, 'svm1', xtrain, ytrain, xvalid, yvalid, xtest, ytest)

Training accuracy: 63.85%

Validation accuracy: 60.06%

Testing accuracy: 61.11%

Overfitting: 2.74%

Log Loss Training: 13.028263760262844, Log Loss Testing: 14.016976317990002

Precision class 1: 51.24%

Precision class 0: 64.74%

Recall class 1: 34.81%

Recall class 0: 78.32%

F1: 41.45%

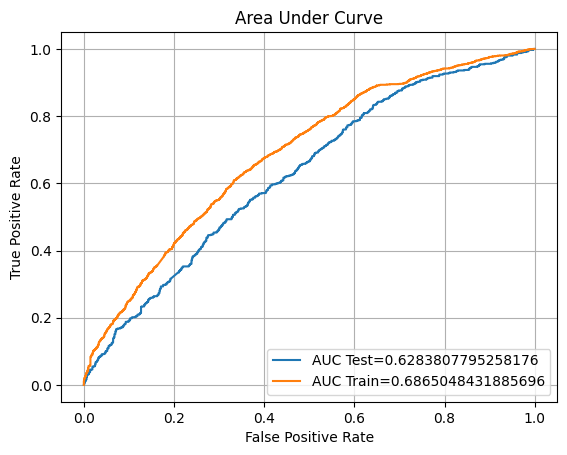

ROC AUC Training: 68.65% Testing: 62.84%

We will try to hyperparameter tuning our model to see if we can improve the

performance.

param_grid = [

{

'C': [0.01, 0.1, 1.0, 10, 100],

'gamma': ['scale', 0.001, 0.01],

'kernel': ['rbf','linear','sigmoid', 'poly']

},

]

#tuned the model using gridsearch and kfold

opt_log = GridSearchCV(SVC(), param_grid, scoring='accuracy', cv=10)

#fit the tuned model with training dataset

opt_log.fit(xtrain, ytrain)

#best parameter tuning result

print(opt_log.best_params_)

{'C': 100, 'gamma': 'scale', 'kernel': 'poly'}svm_v2 = SVC(probability=True, C=100, gamma='scale', kernel='poly')

svm_v2.fit(xtrain, ytrain)

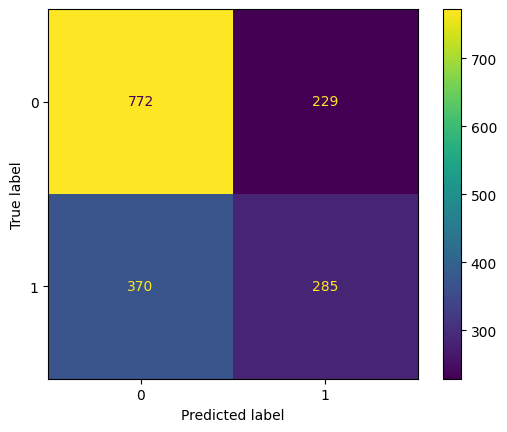

eval(svm_v2, 'svm2', xtrain, ytrain, xvalid, yvalid, xtest, ytest)

Training accuracy: 70.18%

Validation accuracy: 61.93%

Testing accuracy: 63.83%

Overfitting: 6.35%

Log Loss Training: 10.749224862924386, Log Loss Testing: 13.037529215024863

Precision class 1: 55.45%

Precision class 0: 67.60%

Recall class 1: 43.51%

Recall class 0: 77.12%

F1: 48.76%

ROC AUC Training: 76.66% Testing: 65.07%

It seems that both of SVM model that we have created has an overfitting problem. After the

tuning, the accuracy score is increased but the overfitting is as well.

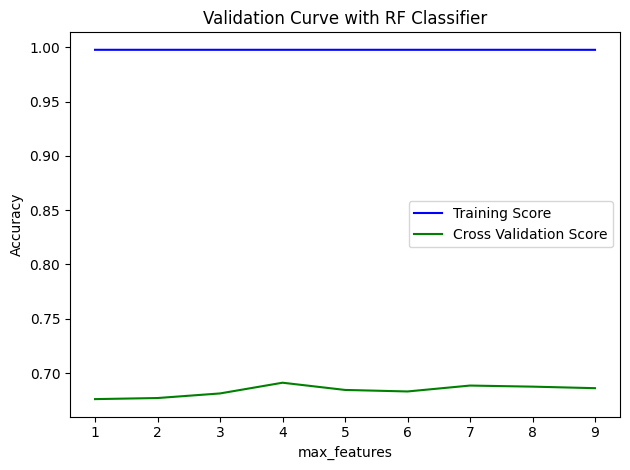

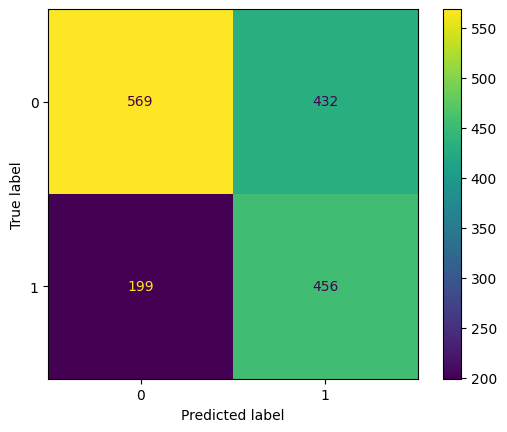

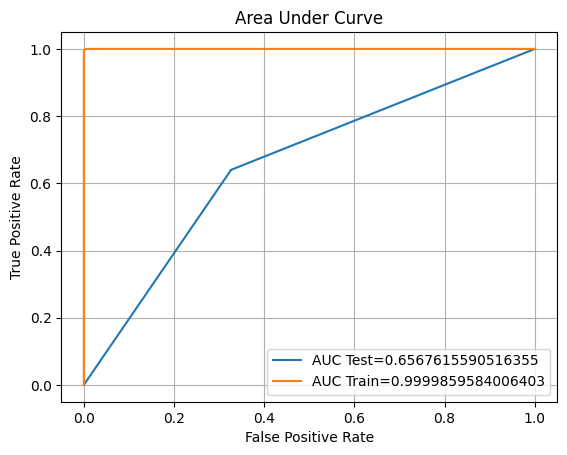

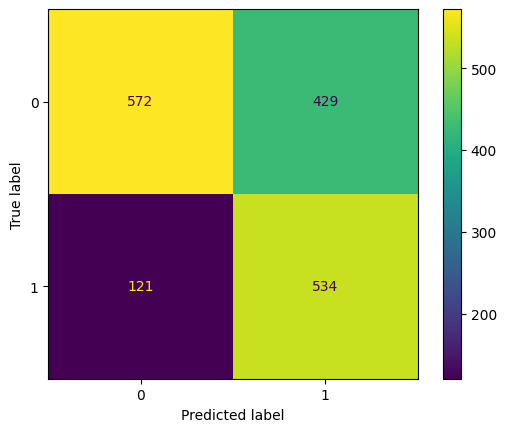

Model 3 - Random Forest Classifier

from sklearn.ensemble import RandomForestClassifier

rf = RandomForestClassifier()

rf.fit(xtrain, ytrain)

eval(rf, 'random_forest', xtrain, ytrain, xvalid, yvalid, xtest, ytest)

Training accuracy: 99.74%

Validation accuracy: 67.49%

Testing accuracy: 66.55%

Overfitting: 33.19%

Log Loss Training: 0.09435511358407653, Log Loss Testing: 12.058082112059724

Precision class 1: 55.78%

Precision class 0: 78.54%

Recall class 1: 74.35%

Recall class 0: 61.44%

F1: 63.74%

ROC AUC Training: 100.00% Testing: 76.33%

The Random Forest Classifier model results in an outstanding accuracy score with the training dataset.

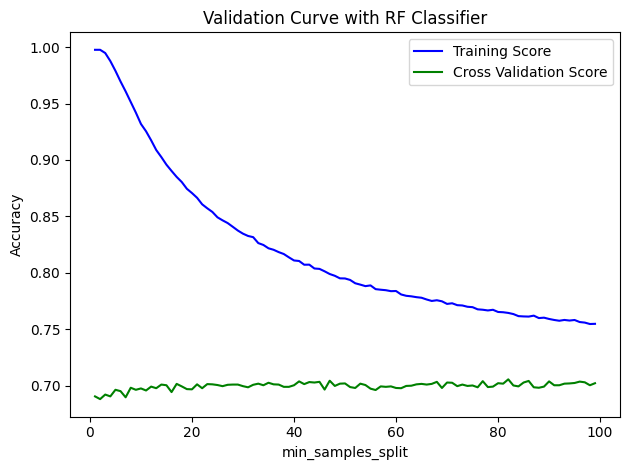

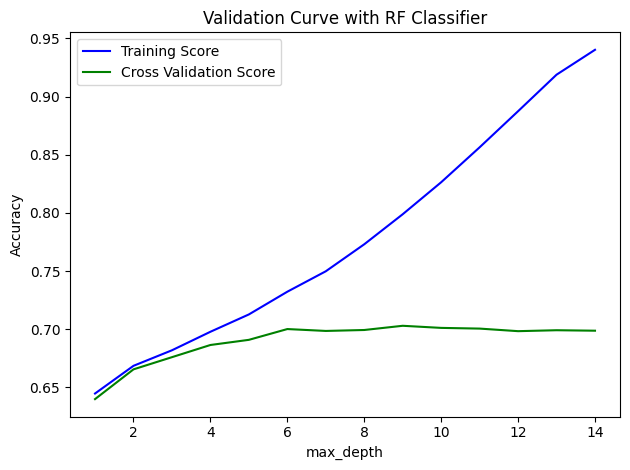

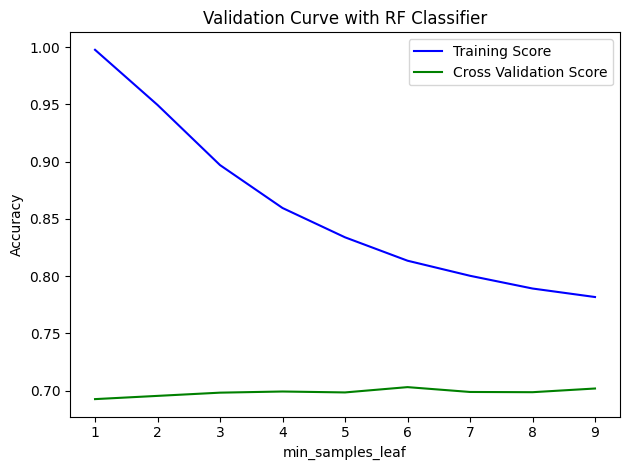

However, it does not have the same performance in the validation and testing dataset, which results in overfitting. Since it takes a lot of computation for the hyperparameter tuning, we will try to visualise the validation manually.

Function for calculate and visualise validation curve

def validations(model, param, prange, x, y, k):

train_scoreNum, test_scoreNum = validation_curve(

model,

X = x, y = y,

param_name = param,

param_range = prange, cv = k, scoring = "accuracy")

# Calculating mean and standard deviation of training score

mean_train_score = np.mean(train_scoreNum, axis = 1)

std_train_score = np.std(train_scoreNum, axis = 1)

# Calculating mean and standard deviation of testing score

mean_test_score = np.mean(test_scoreNum, axis = 1)

std_test_score = np.std(test_scoreNum, axis = 1)

# Plot mean accuracy scores for training and testing scores

plt.plot(prange, mean_train_score,

label = "Training Score", color = 'b')

plt.plot(prange, mean_test_score,

label = "Cross Validation Score", color = 'g')

# Creating the plot

plt.title("Validation Curve with RF Classifier")

plt.xlabel(param)

plt.ylabel("Accuracy")

plt.tight_layout()

plt.legend(loc = 'best')

plt.show()

parameter_range = np.arange(1, 100, 1)

validations(rf, 'min_samples_split', parameter_range, xtrain, ytrain, 10)

parameter_range = np.arange(1, 15, 1)

validations(rf, 'max_depth', parameter_range, xtrain, ytrain, 10)

parameter_range = np.arange(1, 10, 1)

validations(rf, 'n_estimators', parameter_range, xtrain, ytrain, 10)

validations(rf, 'min_samples_leaf', parameter_range, xtrain, ytrain, 10)

parameter_range = np.arange(1, 10, 1)

validations(rf, 'max_features', parameter_range, xtrain, ytrain, 10)

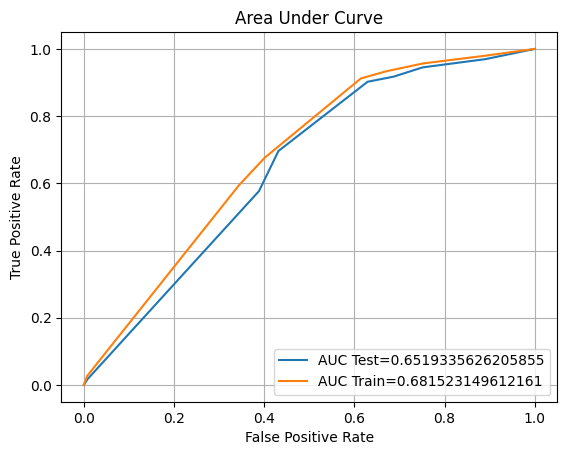

Fitting the parameter based on validation_curve visualisation

RF_tuned = RandomForestClassifier(min_samples_split=100, max_depth=3, min_samples_leaf=15, n_estimators=1, max_features=7)

RF_tuned.fit(xtrain, ytrain)

eval(RF_tuned, 'rf_tuned', xtrain, ytrain, xvalid, yvalid, xtest, ytest)

Training accuracy: 63.15%

Validation accuracy: 62.48%

Testing accuracy: 61.90%

Overfitting: 1.25%

Log Loss Training: 13.282296758373823, Log Loss Testing: 13.734024932688962

Precision class 1: 51.35%

Precision class 0: 74.09%

Recall class 1: 69.62%

Recall class 0: 56.84%

F1: 59.11%

ROC AUC Training: 68.15% Testing: 65.19%

We successfully reduce the overfitting to 1.25% from our Random Forest algorithm from 33.19%. However, our accuracy score is also decreasing.

So, we will move on to our next model.

Model 4 - K-Nearest Neighbor Classifier

from sklearn.neighbors import KNeighborsClassifier

knn1 = KNeighborsClassifier()

knn1.fit(xtrain, ytrain)

eval(knn1, 'knn', xtrain, ytrain, xvalid, yvalid, xtest, ytest)

Training accuracy: 72.51%

Validation accuracy: 56.92%

Testing accuracy: 58.82%

Overfitting: 13.70%

Log Loss Training: 9.907286926328014, Log Loss Testing: 14.84406498271612

Precision class 1: 47.65%

Precision class 0: 64.75%

Recall class 1: 41.83%

Recall class 0: 69.93%

F1: 44.55%

ROC AUC Training: 78.96% Testing: 58.57%

Our KNN model also has the same problem as our previous models. Furthermore, this model also yields the lowest accuracy score up to now.

We will do the same thing as our previous model with hyperparameter tuning.

#parameter dict

tuning_params = {

'n_neighbors' : [19], #from the plot above

"leaf_size":[5,10,20,30],

"p":[1,2],

'algorithm':['ball_tree', 'kd_tree', 'brute', 'auto']

}

#implement hyperparameter tuning to the model

opt_knn = GridSearchCV(KNeighborsClassifier(), param_grid = tuning_params, cv = 10, scoring='accuracy')

#fit the model with training dataset

opt_knn.fit(xtrain, ytrain)

print(opt_knn.best_params_){'algorithm': 'ball_tree', 'leaf_size': 10, 'n_neighbors': 19, 'p': 1}knn_tuned = KNeighborsClassifier(leaf_size=10, n_neighbors=19, p=1, algorithm='ball_tree')

knn_tuned.fit(xtrain, ytrain)

eval(knn_tuned, 'knn_tuned', xtrain, ytrain, xvalid, yvalid, xtest, ytest)

Training accuracy: 65.18%

Validation accuracy: 58.91%

Testing accuracy: 59.66%

Overfitting: 5.52%

Log Loss Training: 12.54923010668215, Log Loss Testing: 14.539348106238078

Precision class 1: 48.77%

Precision class 0: 64.77%

Recall class 1: 39.39%

Recall class 0: 72.93%

F1: 43.58%

ROC AUC Training: 69.89% Testing: 61.47%

We were able to reduce the overfitting percentage and increase the accuracy score a little bit. It seems this model is the most underperformed compared to others.

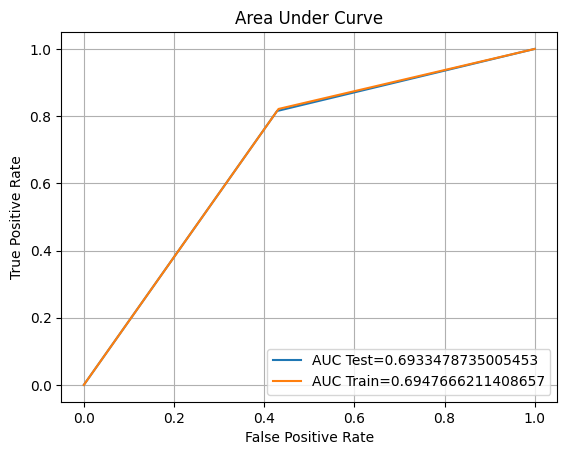

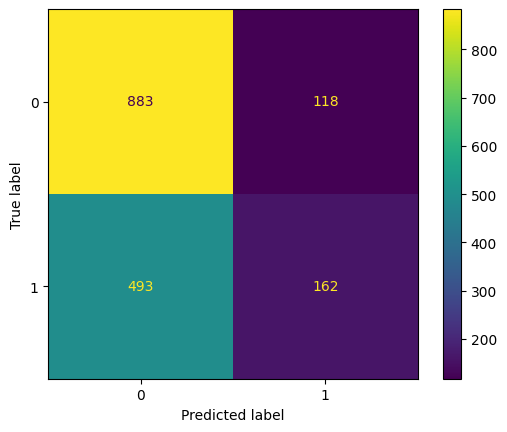

Model 5 - Decision Tree Classifier

from sklearn.tree import DecisionTreeClassifier

dt = DecisionTreeClassifier()

dt.fit(xtrain, ytrain)

eval(dt, 'decision_tree', xtrain, ytrain, xvalid, yvalid, xtest, ytest)

Training accuracy: 99.74%

Validation accuracy: 65.26%

Testing accuracy: 66.00%

Overfitting: 33.74%

Log Loss Training: 0.09435511358407653, Log Loss Testing: 12.253971532652752

Precision class 1: 56.18%

Precision class 0: 74.01%

Recall class 1: 63.82%

Recall class 0: 67.43%

F1: 59.76%

ROC AUC Training: 100.00% Testing: 65.68%

From the result above, it looks like decision tree has the similar results with random

forest Classifier.

random_tree = {'criterion': ['gini', 'entropy'],

'max_depth': [int(x) for x in np.linspace(start = 1, stop = 20, num = 1)],

'min_samples_split': [int(x) for x in np.linspace(start = 1, stop = 20, num = 1)],

'min_samples_leaf': [int(x) for x in np.linspace(start = 1, stop = 20, num = 1)]}

#implement hyperparameter tuning to the model

opt_decTree = GridSearchCV(DecisionTreeClassifier(), param_grid= random_tree, cv = 10, scoring='accuracy')

#fit the model with training dataset

opt_decTree.fit(xtrain, ytrain)

print(opt_decTree.best_params_)

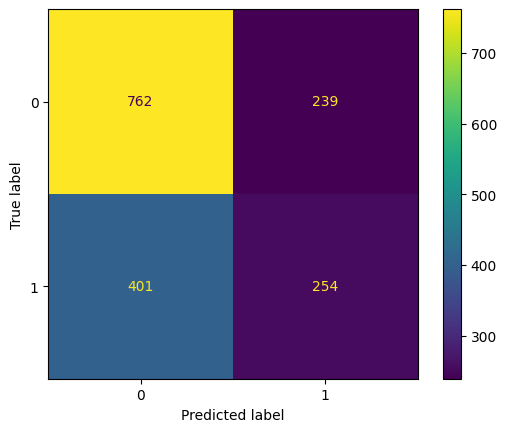

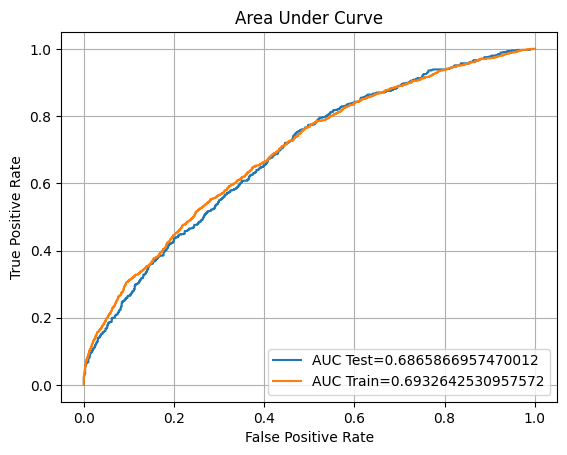

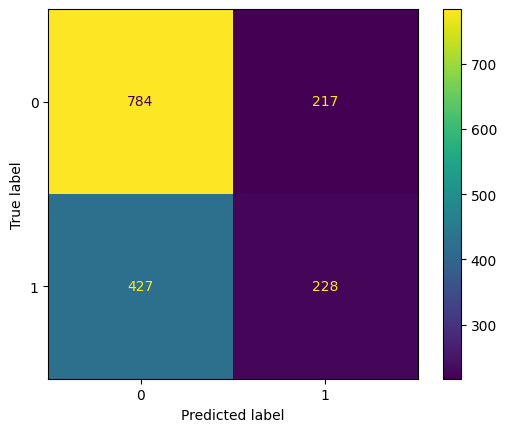

{'criterion': 'gini', 'max_depth': 1, 'min_samples_leaf': 1, 'min_samples_split': 1}dt_tuned = DecisionTreeClassifier(criterion='gini', max_depth=1, min_samples_leaf=1, min_samples_split=1)

dt_tuned.fit(xtrain, ytrain)

eval(dt_tuned, 'dt_tuned', xtrain, ytrain, xvalid, yvalid, xtest, ytest)

Training accuracy: 67.52%

Validation accuracy: 66.47%

Testing accuracy: 66.79%

Overfitting: 0.73%

Log Loss Training: 11.707292170085777, Log Loss Testing: 11.97102014735171

Precision class 1: 55.45%

Precision class 0: 82.54%

Recall class 1: 81.53%

Recall class 0: 57.14%

F1: 66.01%

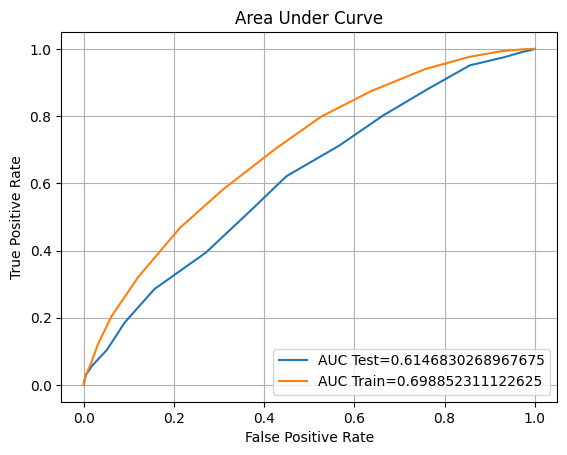

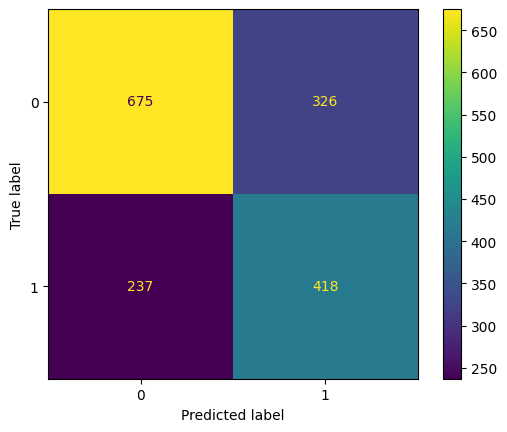

ROC AUC Training: 69.48% Testing: 69.33%

The hyperparameter tuning successfully lowers the overfitting percentage by more than 30% and slightly increases the accuracy score. We will implement our last algorithm before we compare which algorithm is performing better.

Model 6 - Naive Bayes

from sklearn.naive_bayes import GaussianNB

nb = GaussianNB()

nb.fit(xtrain, ytrain)

eval(nb, 'naive', xtrain, ytrain, xvalid, yvalid, xtest, ytest)

Training accuracy: 62.00%

Validation accuracy: 60.06%

Testing accuracy: 63.10%

Overfitting: -1.10%

Log Loss Training: 13.696007641011693, Log Loss Testing: 13.298715109148901

Precision class 1: 57.86%

Precision class 0: 64.17%

Recall class 1: 24.73%

Recall class 0: 88.21%

F1: 34.65%

ROC AUC Training: 65.56% Testing: 64.16%

Unlike our other model, this model has an underfitting problem. We will perform the same procedure with hyperparameter tuning.

params_NB = {'var_smoothing': np.logspace(0,-9, num=100)}

opt = GridSearchCV(GaussianNB(), param_grid=params_NB, cv=10,verbose=1,scoring='accuracy')

opt.fit(xtrain, ytrain)

print(opt.best_params_)

{'var_smoothing': 1.873817422860383e-08}nbtuned = GaussianNB(var_smoothing=1.873817422860383e-08)

nbtuned.fit(xtrain, ytrain)

eval(nbtuned, 'naive_tuned', xtrain, ytrain, xvalid, yvalid, xtest, ytest)

Training accuracy: 62.08%

Validation accuracy: 60.12%

Testing accuracy: 62.92%

Overfitting: -0.84%

Log Loss Training: 13.666975298370438, Log Loss Testing: 13.36401158267991

Precision class 1: 57.19%

Precision class 0: 64.11%

Recall class 1: 24.89%

Recall class 0: 87.81%

F1: 34.68%

ROC AUC Training: 65.55% Testing: 64.13%

Unfortunately, our hyperparameter tuning does not give the best results. So we will compare all of our models and see which one performs better than the others.

Conclusion - Model Selection

We have been implementing 6 classification algorithms to our dataset for the bonds order prediction.

We will see which one has a better performance.

scores = pd.DataFrame(score_comp, columns=['Algorithm','accuracy_train','accuracy_valid','accuracy_test', 'overfit', 'precision1', 'precision0', 'recall1', 'recall0','f1','loss_train', 'loss_test', 'roc_train', 'roc_test'])

scores| Algorithm | accuracy_train | accuracy_valid | accuracy_test | overfit | precision1 | precision0 | recall1 | recall0 | f1 | loss_train | loss_test | roc_train | roc_test |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| logreg1 | 0.63 | 0.62 | 0.62 | 0.01 | 0.53 | 0.66 | 0.41 | 0.76 | 0.46 | 13.25 | 13.69 | 0.67 | 0.65 |

| logreg_tuned | 0.65 | 0.64 | 0.65 | 0.00 | 0.58 | 0.69 | 0.45 | 0.79 | 0.51 | 12.47 | 12.47 | 0.70 | 0.70 |

| logreg_coef | 0.62 | 0.61 | 0.61 | 0.01 | 0.52 | 0.66 | 0.39 | 0.76 | 0.44 | 13.63 | 13.93 | 0.66 | 0.64 |

| logreg_coef_tuned | 0.64 | 0.63 | 0.65 | -0.00 | 0.57 | 0.68 | 0.45 | 0.78 | 0.50 | 12.83 | 12.71 | 0.69 | 0.68 |

| svm1 | 0.64 | 0.60 | 0.61 | 0.03 | 0.51 | 0.65 | 0.35 | 0.78 | 0.41 | 13.03 | 14.02 | 0.69 | 0.63 |

| svm2 | 0.70 | 0.62 | 0.64 | 0.06 | 0.55 | 0.68 | 0.44 | 0.77 | 0.49 | 10.75 | 13.04 | 0.77 | 0.65 |

| random_forest | 1.00 | 0.67 | 0.67 | 0.33 | 0.56 | 0.79 | 0.74 | 0.61 | 0.64 | 0.09 | 12.06 | 1.00 | 0.76 |

| rf_tuned | 0.63 | 0.62 | 0.62 | 0.01 | 0.51 | 0.74 | 0.70 | 0.57 | 0.59 | 13.28 | 13.73 | 0.68 | 0.65 |

| knn | 0.73 | 0.57 | 0.59 | 0.14 | 0.48 | 0.65 | 0.42 | 0.70 | 0.45 | 9.91 | 14.84 | 0.79 | 0.59 |

| knn_tuned | 0.65 | 0.59 | 0.60 | 0.06 | 0.49 | 0.65 | 0.39 | 0.73 | 0.44 | 12.55 | 14.54 | 0.70 | 0.61 |

| decision_tree | 1.00 | 0.65 | 0.66 | 0.34 | 0.56 | 0.74 | 0.64 | 0.67 | 0.60 | 0.09 | 12.25 | 1.00 | 0.66 |

| dt_tuned | 0.68 | 0.66 | 0.67 | 0.01 | 0.55 | 0.83 | 0.82 | 0.57 | 0.66 | 11.71 | 11.97 | 0.69 | 0.69 |

| naive | 0.62 | 0.60 | 0.63 | -0.01 | 0.58 | 0.64 | 0.25 | 0.88 | 0.35 | 13.70 | 13.30 | 0.66 | 0.64 |

| naive_tuned | 0.62 | 0.60 | 0.63 | -0.01 | 0.57 | 0.64 | 0.25 | 0.88 | 0.35 | 13.67 | 13.36 | 0.66 | 0.64 |

From the score table above, we can see that KNN is the most less perform compare to others.

When we see how precise the model is in predicting class 1 and 0, it seems that logistic regression has a better performance compared to others.

However, the percentage of the score is not satisfying. If we can get more data to train our model, we could increase our accuracy score as the model has more data to learn.

For now, tuned logistic regression is our better option with a 65% accuracy score, 58% precision in class 1 and 69% precision in class 0.